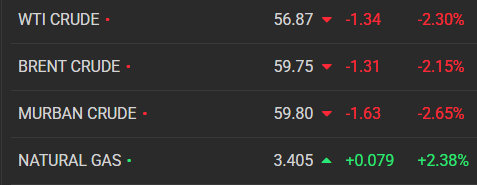

WTI In The $50's, What Now?

U.S. shale is running out of slack. Are we in for a reset?

Introduction

One of the background risks in investing in upstream oil and gas companies is that the fundamental basis for the investment-oil and gas prices, may be destroyed by macro market events. At least temporarily. We still need these products, so the market sorts itself out and we pick up the pieces and forge ahead. Usually in a few months after a trough. Some times a year or two.

A little recent history

It's looking more and more like the near term will repeat the mid-2014-2016 era where the Saudis over-produced to break the back of U.S. shale. In that time the U.S. rig count fell from over 1,900 to under 700. The Saudis have an unbeatable edge in cost of supply, and have now sent signals they are willing to live with some short term pain to regain market share.

They were largely successful in killing off U.S. drilling and high cost U.S. shale production, with breakevens in the $70-80 range, dropped by a couple of million BOPD. Low prices also killed off deep water drilling and rig day rates fell from $6-700K per day to the mid $150's as rig contractors just tried to keep crews together.

It's a different world now and shale operators have much lower break evens-led by increases in efficiency, better understanding of reservoirs, and advances in technology, in the low $40's. The same truth exists for deep water projects that are now FID'd on WTI in the $30's. But who spends money just to recycle it? No one these days, and nothing will be immune from capital allocation decisions.

What else is different now?

Two things have profoundly changed the dynamic from a few years ago. The shift in management compensation from debt fueled, high rates of growth in production toward, profitable operations that enable shareholder returns is one. The other is these companies have used their cash flow to repair their balance sheets, and don't face a cliff or a debt wall as they did in 2020. In short, the industry is much better prepared to tough out a price war if it comes.

What's next?

If we remain in the $50's for any significant amount of time-more than a month, or crack $50 into the $40's, there will be a sharp cut in capex. There are already rumblings in the shale space. Matador Resources, (MTDR) announced a $100 mm cut last week. There will be others if we don’t snap back quickly.

It's clear with less 600 rigs-oil and gas, working for the last year, that except for increased associated gas production, we been balancing on a near-knife edge of new vs legacy production. Any price war led, say 10-20%, drop in rigs or fspreads will quickly result in a 20-30K BOEPD decline each month. We will soon see if producers remember the lessons of the past-the best cure for low prices, is low prices.

Your takeaway

It's hard to pick a bottom. Under the notion, now dismissed that the Saudis might want to avoid a full-fledged price war, the market had defended a $60 floor for WTI. As that became increasingly unlikely, the expectations for WTI are undergoing a reset-downward. The forward NYMEX strip remains in backwardation, turning up slightly toward the end of next year.

One thing we have learned recently is volatility is our constant companion. Meaning with the uncertainty we have now roiling the market we are likely to see a lot of reversals in valuations. What's down one day, could be up the next. That’s been the case recently for the OSD’s. I have an article on OilPrice where I argue that Noble Corp-NE, is in a buy zone. Give it read if you are interested in the sector.

One thing that would calm the market is the announcement of big trade deals that would convince investors that we are not sailing off a cliff. We seem to be on the verge of that, so more volatility lies ahead. But as they-deals, accumulate this should be supportive for the energy market from the demand side.

If we do see a decline in shale output over the next couple of quarters, we will have a structurally different market in my view. That's the direction I think we are headed in. It's a bumpy road now, but if the tariff war de-escalates, and we see a dip in U.S. output, the Saudis could declare victory and support higher oil prices.

Over the short term-gas remains a bright spot and could soften the price war blow to an extent.

Cheers all, Dave