Why Does The Stock Price Of All The Wind Farm Companies....pull a vacuum?

Are there problems with wind farms we aren't hearing about?

I tend to think in financial terms. We hear a lot about wind farms and how great they are, and how they will soon take care of all out energy needs. Everything will be just ducky (that’s an archaic term meaning “ticketyboo.”)

One of the first articles I posted on this fledgling site was on Shell, (SHEL), and how they were misusing capital chasing wind farms. If you haven’t read it, you ought to. Shell’s stock has risen from when I posted it on the strength of strong Q-4 earnings, and a general rally in oil equities. I stand by everything I said in that article, and do not consider the company investable.

I’ll have a full-length piece about the wind business soon, but wanted to get this in front of you. I’ll close this piece with a few individual comments on each company.

Orsted is the biggest dog on this street. Among the projects they are developing is the massive Doggerbank Wind Farm, off the coast of Yorkshire, in the U.K. The target date for completion is 2026, but delays are starting to mount. Could this be the reason Orsted stock is in the tank?

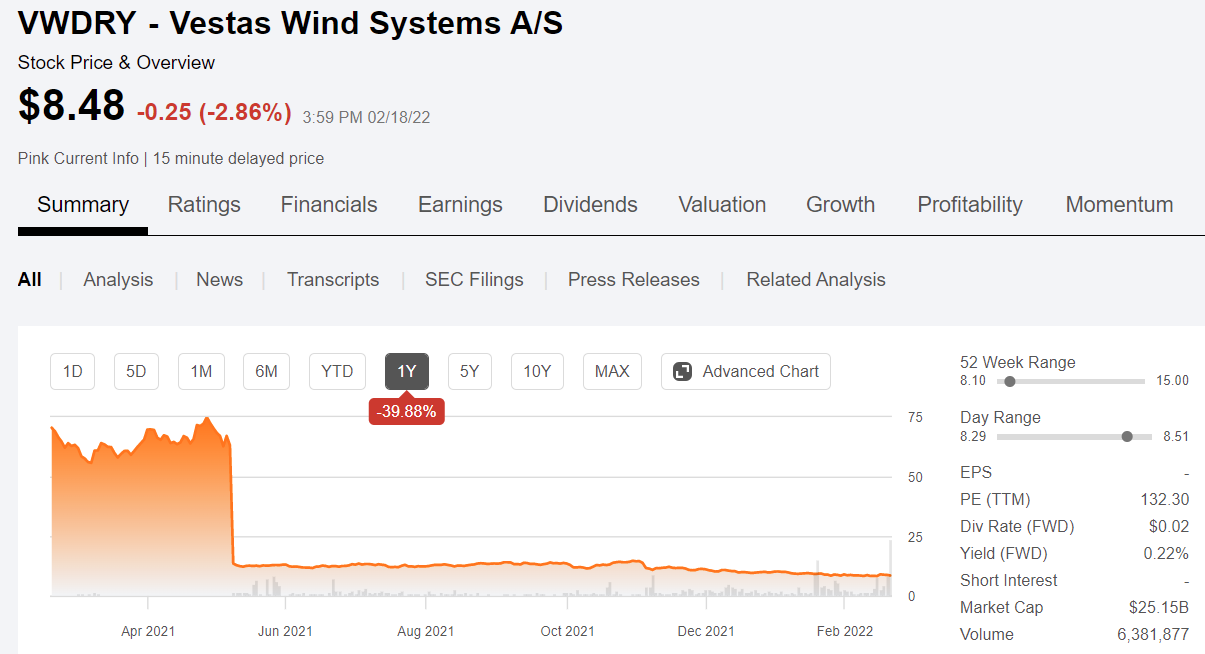

Vestas is another big European wind farm contractor. Last fall they began their slide toward the low $30’s with announcement that “renewables were having tough times.” It was the second warning that year for them along those lines. The company used the “earnings miss excuse-shotgun,” when describing the woes that beset them. Low winds speeds, supply chain holdups, raw materials prices increasing were all cited in a clownshow of an earnings call.

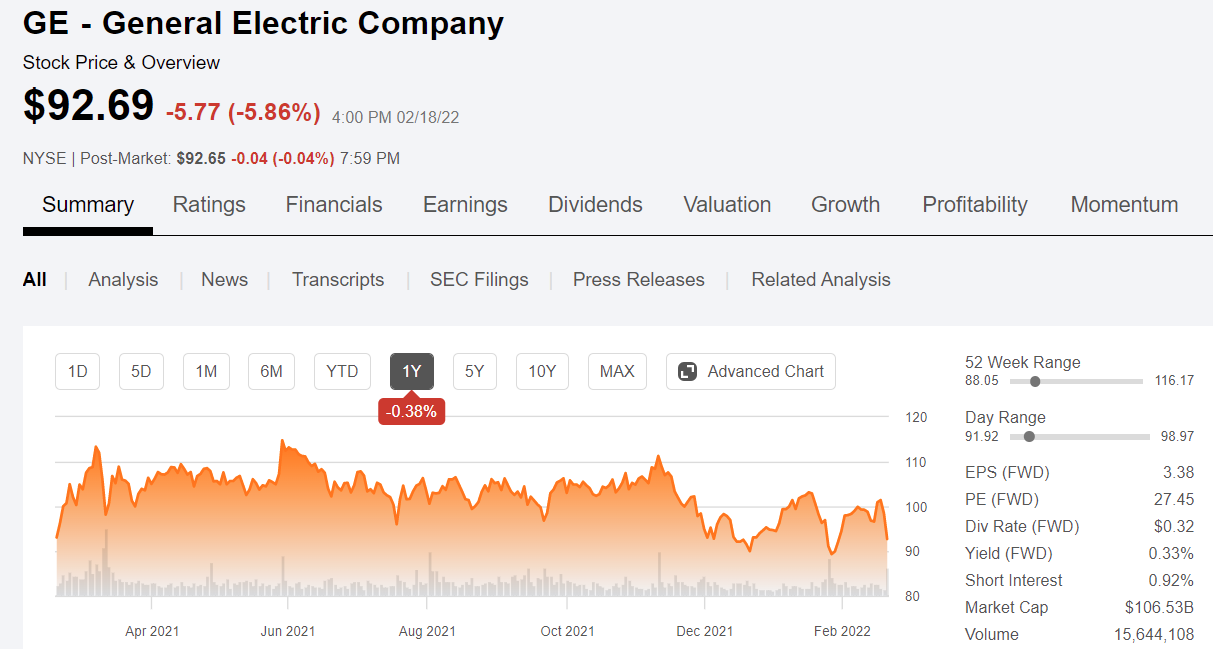

GE is a company that’s had its troubles the last few years. These troubles led to a 1:8 reverse stock split a couple of years ago to get the stock back to where the execs thought it ought to be. It has gradually drifted down since. One of its larger segments is GE Wind Energy.

Your takeaway

The problems with wind farms are in their early days. An article by Robert Bryce in Forbes last year gives an ample run down on some of the problems that are coming to be associated with this renewable.

For my part what most concerns me, is does their stock price just reflect all of the problems that they list? Or are there other questions we should be asking. Are there skeletons in the closet?

Disclaimer. Nothing I say in this article should be construed as investment advice. It may look or sound like it, but it is not. I am not a CPA/CFA and have no formal training/certifications/licences in either discipline. In these articles I present analysis and relevant information that an interested investors may find instructive. I may be bullish, bearish, or neutral and will discuss why, but I am definitely not recommending you buy or sell any security I discuss. Investors should always do their own due diligence before plunking down their hard-earned cash. They alone are responsible for their investing decisions.