W&T Offshore: Ready To Rip And Run

It's been a couple of years since I discussed W&T Offshore (WTI). In that time, it's seen $9.84, and then plunged to $1.41. You can probably put your own overlay as to the timing of these gains and decline in relation to the oil price.

The thing that drew my eye at this point was the price, up 64% this year. But considering where we've come from this year, that's not saying much. I was expecting to see it somewhere above $8.00, after having shared in the meteoric gains many oil operators have seen this year.

At $3.19 per share, that case can't really be made. So let's have a look and see if there is value the market hasn't recognized as yet, or reasons why this one lags its peer group.

The case for W&T

W&T bats clean up. That is to say they buy assets from oil majors that are being shed in a portfolio "high grading" exercise, and wring the last few million barrels of production out of them. All the hard stuff is done for them in terms of building production facilities, platforms, and pipelines, and when they buy an asset all that infrastructure comes with it. Generally, at a steep discount to what it would take to buy it new.

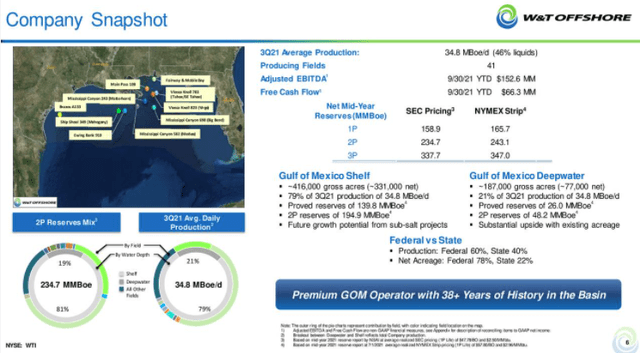

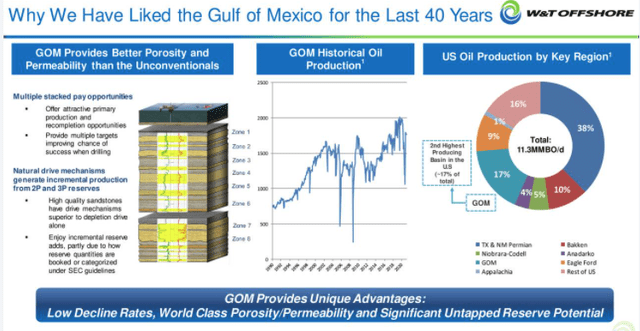

The company keeps its "eggs" in the GoM basket. In past articles I’ve described the difference between shale and the highly permeable sandstone environment in the GoM. The decline rates are much lower than shale, and with all the infrastructure, except for individual well costs, payouts come quickly. Additionally, the drilling inventory has been substantially derisked by the prior owners. W&T gets all the data generated to refine for future exploration opportunities.

W&T

In the present oil price environment, W&T should be able to grow production and sell it at a considerable profit.

The company has also taken steps to improve its capital structure in 2021 by creating a Special Purpose Vehicle-SPV for its Mobile Bay assets. This deal netted them $215 mm, part of which they used to pay off a $48 mm RBL maturity with the rest going to a hedging program for the Mobile Bay assets. The market seems to have approved of this deal as the bonds securing its $695 mm long term debt, due in 2023 have risen from the low $70s to the mid-$95s.

Finally, the company has steadily reduced reserves acquisition costs from the mid-$30s in 2014 to less than $5.00 today. Much of this has come from lower service company costs and success coming from high grading drilling prospects.

All of this adds up to a compelling reason to take a hard look at WTI...at the right entry price.

A possible catalyst to move the stock price higher

W&T has done a good job of high grading their drilling inventory to pick winners. With a lot of experience in the GoM offshore plays, they have history and experience sifting through candidates. When you add that to the huge stores of data they can outright buy, or acquire when they pick up a new property, their chances of turning an exploration test into a producer is significantly enhanced.

Source

The proof is in the pudding. The slide below highlights several instances where over time their expertise has extended the life of a producing asset, and in these cases actually found enough new reserves to add to the total.

WTI

The big companies have largely withdrawn from shallow, and more recently deep waters in the GoM. The shelf was considered "drilled up" a couple of decades ago. The jackup rigs I worked on in the 90’s slowly dispersed to the 4-corners of the earth, or a silent graveyard to rust in the sun as operator interest has waned in the shelf.

That doesn't mean there is nothing left as WTI has demonstrated. What happens, and we see today is that a play no longer fits within an operator's risk pool to compete for capital. If they are not going to spend money on it to develop buried resources, it is often the best decision to send on to someone who can. That's where WTI enters the picture.

In the oil price environment we have today, with its low costs due to knowledge of the GoM plays, and the infrastructure that came at a fraction of its installation cost, WTI should generate considerable free cash in 2022.

Some examples of their wringing new oil from oil wells would be a couple cited by Tracy Krohn, CEO in the last call-

During the third quarter of 2021, we performed two workovers that had initial production rates totaling, approximately 1075 net barrels of oil equivalent per day.

Additionally, we performed one recently with additional a production rate of approximately 400 net barrels of oil equivalent per day. These are very strong results that are both highly economic and help us to mitigate natural decline.

I don't have enough information to get too specific. Generally, workovers on old wells involve a quick P&A (plug and abandon) of a lower primary zone that's watered out, a perforation of an upper zone that was left behind originally, and perhaps a frac-pack, and then a rerun of the tubing string. Note - this is way oversimplified and they do not always go smoothly. I've done workovers that took a few days, and I've done workovers that took a couple of months. Assuming all of that goes according to prognosis, a couple of hundred grand upfront and you have 500-1,000 bbl of new long-life production.

Q-3 report

WTI beat on the top and bottom lines for Q-3. Revenues of $131 mm were a modest improvement over Q-2, and impacted by Hurricane Ida. Cash from operations came to $65.1 mm, a multi-year high. Capex was $10.2 mm. Hedging also resulted in a $38 mm loss for the quarter. Cash on the books rose to $256 mm, a rise of $50 from the prior quarter and stemming from a loan made through the CEO's separate company, Calculus Lending, to remove constraints placed by banks on RBLs (Reserve Backed Loans)

Tracy Krohn comments on the conversion from the traditional RBL-

Yes, that the RBL lenders have certainly have experienced a lot of losses primarily onshore, but some offshore as well. What 250 plus companies went bankrupt the last three years most of those were onshore.

They are experiencing issues with their shareholder base surrounding ESG and requirements. I'm not sure that necessarily issues they are just requirements for their shareholder base. We are seeing this more with the foreign banks, European banks in particular then we have expected to encounter.

So it was more expeditious for us and less onerous to go ahead and shut ourselves of the of the RBL.

Source

Debt

As the slide below notes, the company has a history of growing through acquisitions and debt has accumulated as a result. WTI is taking steps to improve their balance sheet as noted in the in the call. They are generating at current strip prices, and after hedges about $230 mm in OCF on one year basis. Interest costs are running about $65 mm a year, which, after typical capex of $30 mm, leaves them plenty of money to chip away at that figure if they choose to do so. With the cash they have on the books, and the cash flow being generated, WTI doesn't pose a risk of default.

Source

Your takeaway

There have been several times I've wished I'd gone long WTI. Each time I looked at the company it was about where it is now, and shortly rallied to near $10. So if a micro-cap like WTI fits your risk profile, at current prices they are worth a look. The two analysts who follow WTI are both rating it as a buy at present prices, with a $6.00 ish target.

One key concern is what the company does with their present cash flow. They mentioned on the call they are always looking at new acquisition targets. That's fine. It's how they've grown the business. I still wish they would commit to reducing LT debt, but couldn't find much indication that it was a particular concern on their part. Okay, that $696 mm comes due in 2023 and interest rates could be a lot higher then.....

The company is trading at ~5X adjusted OCF, so not near a particular danger zone. If they hit the $3.00 mark in this current COVID sell-off, I will probably enter the stock. I will not chase it. That hasn’t been the direction the stock has taken so I may have missed my entry point in WTI this cycle. Patience grasshopper!

WTI is not a company to park cash in and let it ride. Have a plan if you decide to take a stake and when your target is hit, set a stop.

Disclosure. The author has no position in WTI.

Disclaimer. Nothing I say in this article should be construed as investment advice. It may look or sound like it, but it is not. I am not a CPA/CFA and have no formal training/certifications/licences in either discipline. In these articles I present analysis and relevant information that an interested investors may find instructive. I may be bullish, bearish, or neutral and will discuss why, but I am definitely not recommending you buy or sell any security I discuss. Investors should always do their own due diligence before plunking down their hard-earned cash. They alone are responsible for their investing decisions.