Valaris Ltd: The Seagulls Are Seeing Something I'm Not

We are believers in the nascent offshore cycle, but VAL has gotten ahead of its skis.

Come on. You gotta be kidding me. Valaris, (VAL) is selling for 50X PE? On what planet does this makes sense? Halliburton, (HAL) struggles to get 9X PE. Schlumberger, (SLB) notches barely a 15X. So, companies that are putting billions on the balance sheet are selling at a discount to a contract driller, with one rabbit to pull out of the hat-rigs. I realize I am on a rant here, and need to get off my soapbox. That said, the question remains, what would compel you to pay 50X EPS for a company as volatile as VAL, with some of thesame management that drove them into bankruptcy a couple of years ago?

But...wait, there's more. The analyst cadre is high on VAL with an unabashed buy rating and a price range of $80-$120, and a median of $95. EPS estimates have been coming down for Q-2, from $0.57 three months ago, to a -$0.21 currently. Wow! What am I missing?

In this article we will run through the Cc and financials in search of what in the world is driving these valuations. If anything.

The thesis for VAL

The company participates in both deepwater and shelf-type work with a sizeable fleet of floating vessels-11 drillships-2 stacked, and an option for 2-more, 5-Semis-2 stacked and a larger fleet 29-4 stacked, and 11 managed rigs 2 -GoM, and 9-through the ARO JV, of jack ups for their respective areas of application. VAL has a newly "refreshed" balance sheet and has been operating in the black for several quarters. It has also pumped the backlog back above $2.8 billion as referenced in the Q-1 earnings release.

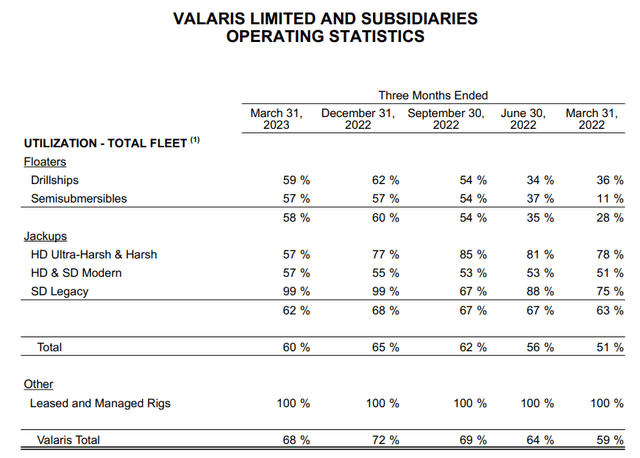

There is no question that the market for deepwater rigs is on the increase. We hear it from the drillers themselves, then Rystad chimed in with their estimates of contracting opportunities for 23/24. Rig utilizations are above that magic 80% level that signals a shift of pricing power to the rig companies, although it should be noted that VAL's fleet utilization current stands at 68%.

And, we hear it in the day rates being tossed around. Rigs are starting to be contracted for day rates not seen in a decade-mid $400's, and contracts are being let for longer terms, years in some cases. All are signs of an increasingly healthy industry. CEO Anton Dibowitz commented on the market emerging in offshore drilling-

Improvements in ultra-deepwater demand has been geographically widespread, and based on customer conversations, we anticipate that many rigs due to complete contracts over the next few years will likely be retained by their existing customers. As a result, we have seen active drillship utilization increase from approximately 75% to around 95% over the past couple of years. On the jackup side of the business, the number of contracted jackups has increased by approximately 15% from lows in early 2021 and is at the highest level since mid-2015.As a result, active utilization for jackups is approximately 90%, and day rates are in the low to mid $100,000, with leading-edge rates continuing to trend upwards.

Areas of strength noted by management in the call for DW rigs include, the Golden Triangle, East Africa and the Mediterranean for ultra-deepwater floaters. VAL sees 20 to 25 opportunities with expected duration of greater than one year that are anticipated to commence over the next couple of years. 12 to 15 of these opportunities will need to be met by either incremental reactivations of stacked and stranded new build rigs or active rigs moving regions. Generally VAL expects this demand will come from reactivations.

Africa and Brazil are another couple of DW hotspots. Offshore Africa, several basins, including Angola, Namibia, Mozambique and the Mediterranean will have upcoming tenders. In Brazil, further tenders are expected, and consequently, the contracted rig count is expected to grow over the next 12 months.

The company noted also that the GoM will have incremental new opportunities with very few uncontracted rigs in the theater. Longer term contracts and a long field of view for operators needing rigs for yet unsanctioned projects. Noting also that the pool of available rigs is shrinking, and that the economics of reactivating stacked rigs are favorable in comparison to securing new builds out of Korean shipyards.

In summary, VAL sees a strong market with exceptions noted in the harsh environment category-Norway, and the UK, where they may redeploy some stacked fixtures. Rising day rates, longer term contracts, and increased fleet utilizations across the board form the thesis for investing in VAL.

Finally, the Jack up deal with the Saudi ARO JV is positive for the company that gives it a well-funded base of operations in the Middle-East theater, and steady cash flow from a strong customer. CEO Dibowitz commented on the ARO operation's prospects-

Saudi Arabia is an attractive, growing and sustainable market, and ARO is attractively positioned with its 20 rig newbuild program. The delivery and startup of the first two newbuilds will mark an important milestone in the growth story of ARO.

Risks

The key risk to me, considering a position in VAL is the PE and cash flow multiple. I am stunned the market awards this inflated multiple to a contract driller. I acknowledge again that I came out in favor of Transocean, (RIG) with no earnings multiple, but a drilling rig is a big hole in the water with absolutely no other use. At the end of the day OSD's are businesses subject to the laws of gravity, as the recent round of bankruptcies will attest. For reference, competitor Noble Corp, (NE) trades at 15X EPS and has several authors ranking it as a strong buy. I would have to think some of this bullishness is related to financial fundamentals.

Q-1, 2023 and guidance

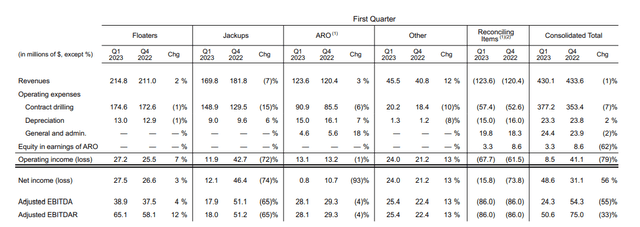

Q-1 notched another quarter of improving performance that was boosted well above analysts expectations by some one-off activity-Forex of $13 mm and tax gains of $28 mm. Hits to the harsh environment fleet cost revenue a few million QoQ, landing at $430 mm. Drilling expense drove costs higher to $377 mm from $353 mm. About $20 mm of that was reimburseable to clients, making the net around $353 mm. Liquidity at the end of the quarter ran to $844 mm, an increase from $749 mm as a result of cash and cash equivalents, and was driven by cash from operations.

VAL also announced an enhanced capital structure and liquidity through a refinancing in April 2023, including the addition of a $375 million revolving credit facility.

Valaris Board of Directors authorized an increase in the Company's share repurchase program to $300 million in April 2023. Nice the stock doubles in a year and it's time to repurchase shares. Genius.

VAL is affirming previous guidance for 2023.

Your takeaway

I can't get there. I can't get to a hold, let alone a buy. The company's valuation is simply too rich for me using conventional metrics, and knowing what I do about the boom and bust quality of the industry.

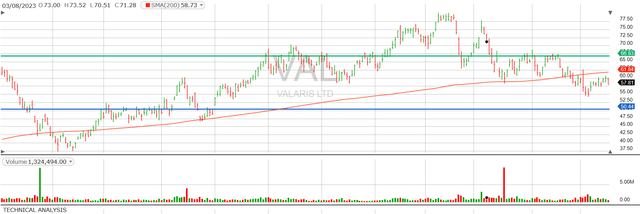

Intriguingly to me the smart money that entered in June, 22, bailed in March, 23, and I really don't see anything here that tells me to buy at current levels. We have bounced off resistance at $66 twice, and are below the 200 day SMA.

At nearly 50X PE the company is too rich for me. That doesn't mean they won't hit analysts targets of $120. A couple of tanker highjackings. Perhaps a new war starting someplace and VAL could hit that target in a few weeks. If they do, I would be a seller and wait for gravity to reassert itself.

In a beaten down upstream energy sector we don't have to look hard to find better opportunities to deploy capital.

Disclosure. The author has no position in VAL.

Disclaimer. Nothing I say in this article should be construed as investment advice. It may look or sound like it, but it is not. I am not a CPA/CFA and have no formal training/certifications/licences in either discipline. In these articles I present analysis and relevant information that an interested investors may find instructive. I may be bullish, bearish, or neutral and will discuss why, but I am definitely not recommending you buy or sell any security I discuss. Investors should always do their own due diligence before plunking down their hard-earned cash. They alone are responsible for their investing decisions.