I have written frequently about Tetra Technologies, (TTI) on another platform over the years. Success always seems to be a quarter or two away for this legacy Oilfield Services-OFS, provider. I had thought their proprietary Neptune fluid would prove to be a catalyst as far back as 2018. It hasn’t worked out that way for a lot of reasons. I am not going to spend any digital ink discussion Neptune now. If they sell a bunch of it we may revisit the topic. They have Neptune “irons in fire,” so they tell us, but we’ve been hearing that for years.

For those who aren’t familar with them. TTI has three core businesses-

Oilfield fluids, additives, and field service

Water treatment and management services in the shale patch.

Chemical manufacturing for industrial applications and for their own bromine supply.

The news of their partnership with EOS Corporation, (NYSE:EOSE) is what drew my eye this time around. Primarily because the subject matter, Flow Batteries interested me and I thought it might interest you good folks.

In this article we are going to focus on the mineral and resource catalysts that we see emerging, and give the oilfield businesses a pass.

What are we talking about here?

You can read the press release for yourself, but I will summarize the key parts of what this partnership entails. TTI manufactures a chemical known as zinc bromide in their Magnolia, Arkansas facility. By manufacturing, I mean that TTI adds zinc oxide to elemental bromine to make the final product, ZnBr2. For the past forty years the main application for ZnBr2 has been as a heavy completion fluid used in oilfield completion operations. ZnBr2 had a couple of attributes that made it attractive to use this way. One, it enabled a density of as much as 2.45 s.g. (Roughly two and a half times the weight of water.) Two, it lowered the true crystallization temperature, (TCT) of a fluid.

Those were the positive attributes. There were also some negative ones. The low pH of the fluid made it a weak acid and therefore it was risky to handle for field workers. To a large part proper preparation and personal protective equipment, (PPE) mitigated this risk, although you can probably imagine how miserable wearing a neoprene slicker suit in the GoM in summer can be. Then comes the biggie.

Zinc is an EPA listed material and bioaccumulates up through the foodchain. It is an known teratogen and therefore comes with strict discharge limitations. As a combination of risk to personnel, and the EPA reporting requirements, oil companies have been increasingly reluctant to use it. Several former manufacturers of ZnBr2 have withdrawn from the market as well. These actions have proved to be timely as alternatives to the use of zinc are now marketed.

So, the fact that a new use for ZnBr2 has come along is welcome news to TTI and could be an increasing source of revenue in the coming years.

The Zynth battery and EOS

The oil industry has long known that leaving zinc bromide as a packer fluid was a great way to have tubing failure, or come back to rotted casing in a couple of years. Zinc bromide is an electrolyte and readily enables ion transfer from metal into the brine. Even with corrosion inhibitors applied, at elevated temperatures, zinc posed an unacceptable risk. There's a lot more to the corrosion story, and we're going to stop here on that subject.

But, that very characteristic is what makes ZnBr2 a powerful candidate for use in batteries designed to store power generated in daylight from solar arrays. When the sun goes down they then discharge this stored energy into the grid.

Note- I am going to be using some graphics from an EOS presentation to illustrate certain points I make. This article is not about EOS as I have only done a cursory review of the company. They appear to have good prospects, a substantial order book and backlog, but are just moving out of the startup phase with little current revenue and no earnings. I don't know how their current <$8.00 share price is justified anymore than the $31 price tag in February of this year. They will more than likely grow into this current ~half a billion dollar valuation, but it's anybody's guess as to when.

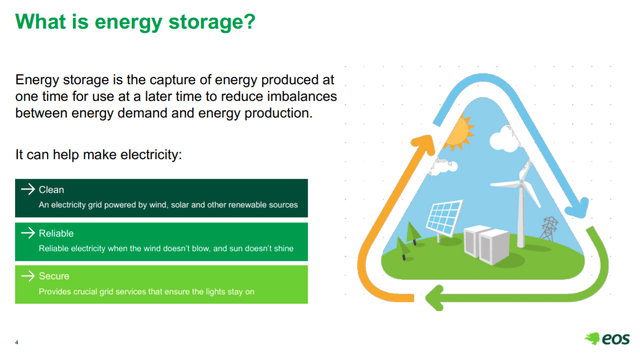

If you are struggling with the concept as described above, this graphic sums it up nicely. In between wind and solar are neat arrays of chemical batteries ready to kick in and deliver power when the wind fails to blow and the sun don't shine.

There is some interface between Li batteries and flow batteries as noted in the EOS graphic below. The point EOS is making here is that to accommodate the entire range of applications different technologies appear to be best suited for unique situations. The segment EOS has targeted is the standby commercial power segment.

So what is a ZnBr2-Zynth battery?

Traditional ZnBr2 flow batteries rely upon separate chambers to flow the ZnBr2 solution across membranes coated with zinc in the charge cycle. The ion transfer creates current which provides the electro-motive force for the discharge cycle. In graphic below EOS describes their static battery, marketed as the "Zynth," as a step-change improvement over the flow battery.

Why ZnBr2 batteries? They come with a lot of pluses and a few minuses. On the plus side-

100% depth of discharge capability on a daily basis.

Little capacity degradation enabling 5000+ cycles

Low fire risk as electrolyte is non-flammable

No need for cooling systems

Use of low cost and readily available battery materials

Easy of end-of-life recycling using existing processes

On the con side-

Lower energy density than li-ion batteries

Lower Round Trip Efficiency than li-ion (although this can be partially offset by the energy drawn from li-ion installations to run cooling systems).

The need to be fully discharged every few days to prevent zinc dendrites that can puncture the separator.

Lower charge and discharge rates than Li-ion

Now you will remember I said the market was segmented. Li-ion battery has been widely adopted for transportation. If you have any doubts about this just look at the 2-year chart on Albemarle Corporation, (NYSE:ALB), ranging from $56 in March of last year to as high as $280 last month. What the Zynth battery is particularly suited for is the deep discharge, daily cycling needed by solar and wind power installations for grid power.

So what does all of this mean to TTI?

Well, it’s hard to say. Neither TTI or EOS have any sort of revenue recognition for booked orders or backlog that relates to the sale of TTI's PureFlow, UltraPure Zinc Bromide. But, Brady Murphy, CEO of TTI noted in the last call that a resource viability study would get underway in 2022.

We're planning to drill an exploratory well in the fourth quarter on our dedicated acreage to obtain lithium and bromine samples, allowing us to move from exploration target to an inferred resources target phase.

We then intend to move towards a PEA study in early 2022. There are significant value in our mineral rights in the Smackover Formation in Arkansas from a combination of our option agreement with Standard Lithium, our bromine resources to meet the growing demands for completion fluids and energy storage, in addition to our 100% TETRA owned lithium resources. We will continue to evolve these resources to create shareholder value.

TTI Q-3 call

This being a financial blog, we have to take a SWAG. And, I do mean a SWAG. If TTI gets payments of $5.0 mm per year from the EOS agreement for 30 years, cash flow would be $150 mm. Multiply that by 3X and the present value would be $450 mm. Or about what the entire company is worth now. I have a feeling that is way low, given the incentives being handed out by the government for projects of this type. But it’s early days and it’s best to be conservative.

Notes from Q-3 Tetra's financials

This a financial blog so we will touch on the current quarterly report while acknowledging these core businesses are not seeing a lot of growth at present. That said if my theory about drilling picking up next year is on track, those dynamics could change.

At its current price $2.84/share, fits the defition of "microcap" handily and shares can react with a high beta to the up and downsides.

Forward EBITDA is about $60 mm with free cash at $20 mm annualized from Q-3.

Shares have ranged from about $.72 to $4.50 this year. My one-year target price of $5.00/share looks pretty distant now. But most observers think the oilfield is bottoming from the current selloff, making the current prices an opportunity.

The company is focused on deleveraging and has repaid about $40 mm thus far in 21. The company restructured its ABL in the third quarter, saving about $3.0 mm in interest payments. As of Q-3 the company has no maturities until 2025. There is about $42 mm of cash on the books, and with their ABL availability about $90. TTI poses no risk of near term default.

Your takeaway

I could be way off on these projections for PureFlow. But, let’s not quibble now. Let's agree that a lot of things have to break for this partnership to realize any of this revenue, but the wind is at their back.

The fact that EOS has a firm order from a major utility company at their stage of development-still very researchy, still very expansion and capex oriented, is very encouraging to me. Joe Mastrangelo, CEO of EOS comments-

We’re at booked orders of over half a gigawatt with the backlog now at $150 million. We’re very excited about the project that we’ve announced with Blue Ridge and Pine Gate - it’s an exciting opportunity for us, but also the follow-on order from Duke and a new order from Amaresco.

Our opportunity pipeline continues to be robust with over 22 gigawatt hours. What we’re seeing as we look in the market is continued growth on the opportunity front.

Now they have to execute. A lot of their seed capital comes from the Koch brothers, who have taken 15% equity in EOS for $100 mm. So they've impressed a hard-nosed venture capitalist for working capital. For whatever that's worth.

TTI is selling at $2.84 a share now, having declined from just over $4.00 a few months ago. Sellers of this equity are only valuing the ongoing completion fluid and water management businesses that we have written about extensively. Even taking those businesses at current revenues, TTI should be selling for more that it is now. Their current valuation of $300 mm is only 75% of the ~$400 mm worth of revenue that TTI will generate this year.

Source

It's time to stop thinking of TTI as just another oilfield service company. They are also a resource company, and control resource assets in the form of elemental lithium and bromine that could one day bring $10's of millions annually to the bottom line.

Another lever worth mentioning is their agreement with Standard Lithium, (SLI), to extract elemental lithium from their Arkansas site. TTI gets paid for the lithium and bromine extracted, and gets shares of the SLI. No TTI capital is tied up here. It's as close to free money as you will ever get. What? You thought all those gubbamint checks were free money? No they weren't. Your paying for it now with $20.00 a pound steak prices and the price of everything else going up 5-6% a month. I've never seen inflation like this and I lived through the 70's. I am getting off track here. The valuations of SLI shares had increased significantly. Elijio Serrano comments about their SLI holdings-

And Brady mentioned earlier, that the share price of Standard Lithium increased another 40% in the month of October. We do not have any holding restrictions that might prohibit us from monetizing these assets. From the beginning of the year to the end of September, the value of this equity holdings have increased by $11.8 million. And as you evaluate our balance sheets, our liquidity and our cash position one must recognize that we had $22 million of marketable securities as of the end of September available to us to monetize at the appropriate time.

Source

I think investors with a moderate risk tolerance and a strong heart might want to consider TTI at current levels. The company is trading at just 1X revenue at current valuation, and 6X forward EBITDA. With the coming growth in the oilfield for 2022, and royalty and mineral sales we’ve discussed, I don’t see a lot of downside. Hopefully, ‘22 is the year they break out this multi-year slump.

Disclosure. The author is long TTI.

Disclaimer. Nothing I say in this article should be construed as investment advice. It may look or sound like it, but it is not. I am not a CPA/CFA and have no formal training/certifications/licences in either discipline. In these articles I present analysis and relevant information that an interested investors may find instructive. I may be bullish, bearish, or neutral and will discuss why, but I am definitely not recommending you buy or sell any security I discuss. Investors should always do their own due diligence before plunking down their hard-earned cash. They alone are responsible for their investing decisions.

Are you still following Tetra? The longer I own it the more I like the company. Have been adding here and their for 2 years now.