Tellurian: Long-Shot Smitty's Choice In LNG

Dirty Harry said it best, "Ya feel lucky?" Long-Shot Smitty always feels lucky

Tellurian, (TELL) is one of those speculative stocks that seem cast a spell over the "Long-Shot Smittys" of the world. You know the type. Always hoping for the big payday, and putting it all on black at the roulette wheel. TELL’s relatively low stock price (I won't say-cheap, as it has no earnings, little revenue, and limited but not inconsequential assets, making any sort of valuation difficult.), that tempts the Long-Shot Smittys with a few shekels to spare with dreams of the big score. Dreams that seem to get pushed further out with every press release.

On the plus side, TELL has some compelling assets. One being the site upon which it hopes to build Driftwood LNG, and the Haynesville gas reserves that will supply it. Then there is its chairman, and bombastic impresario, Charif Souki, best known for largely inventing the current business model under which LNG exporters and would-be exporters are lining up to build multi-billion dollar castles to compress, chill, and ship America's boundless gas reserves to points east. A feat he last accomplished when he ran what is now the biggest LNG shipper, Cheneire Energy, (LNG), converting it from a degasification mode, whereby foreign LNG shipped to the U.S. would be sold into our markets, to its present configuration, that sends our gas overseas.

Finally and perhaps their premiere asset is the fully permitted status of Driftwood LNG, that has enabled TELL give the prime contractor, Bechtel, notice to proceed.

Sometimes an encore is tough to pull off, and that's a fair assessment of the tap-dancing Souki must now do to keep the hounds of ill-fortune at bay. In this article we will review recent events, and provide our view as to whether DriftWood LNG-a proposed 27 mpta, 5-plant colossus, can grow legs and walk, or leave Long-Shot Smitty holding losing ticket.

The emerging LNG market circa 2027-ish

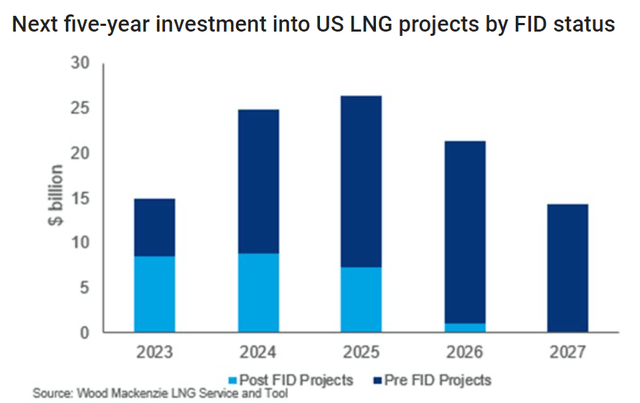

Like any commodity supply/demand move, resources are developed until there is excess capacity. We see it historically in upstream crude oil and gas supply, and it continues through the value chain to derivatives like LNG. We see it today with gas supplies in storage that weigh on Henry Hub prices. WoodMac projects that U.S. LNG export capacity will more than double from present day to as much as 190 mpta in 2027 with over $100 bn of direct investment. It is into this market that Driftwood LNG will arrive, in the case where it actually is built.

WoodMac analyst, Sean Harrison, is quoted in the report, noting the competitive pressures emerging-

As developers continue to push more projects forward, competition for service contracts will rise, creating a squeeze on both work force and material prices. This could cause further cost inflation, along with delays to some projects. The combination of low fees and increasing costs mean we estimate unlevered internal rates of return (IRRs) as low as 5-6% for some projects. Based on these returns, some projects are finding it challenging to secure finance, particularly via equity raises,” said Harrison.

I don't mean to call TELL out on this point about securing financing, but it is, after all, the missing link in the TELL saga. Harrison didn't either, but you know...

The thesis for TELL

As we have discussed so far Driftwood has the makings of a solid project with a number of key factors in place. Among them-a world class site, permits in hand, a local, low cost supply source for about half of the Phase I throughput, and tuned-in management that knows the business backward and forward. What's missing?

Signed Sales and Purchase Agreements-SPA's, for one. And, of course financing for about 1/3 of the estimated $14 bn to build out Phase I. Pesky details I expect Chmn Souki would say, but there we are. A wee bit short of cash to build Phase I, and, perhaps related, a few SPA's short of an LNG carrier load a few years hence.

On the SPA front, they have actually been going in the wrong direction, losing SPA's with Shell, (SHEL) and Vitol, last fall. It's last remaining SPA with Gunvor, is on shaky ground reportedly. That isn't marketing the way I remember it.

As we tie a bow on this section, we come finally to the financing imbroglio. TELL is seeking equity partners for up to a 40% stake in Phase I. A quick glance at the slide above shows the non-standard capital structure of Driftwood. Over half is made up of LT debt and bonds, with cash flow from future sales of LNG making up about 15%, leaving investors with the balance. An outcome made more urgent and perhaps more tenuous is the fact that limited construction is underway.

As I look at this slide, the thought occurs to me, WWMWS? (What would Mr. Wonderful Say), if presented this scenario on Shark Tank? Mr. Wonderful would likely ask Souki, "What's your moat?" To which Souki might mention the guaranteed supply he has coming from the Haynesville. As the Haynesville is currently producing 11.7 BCF/D, I doubt Mr. Wonderful would find this compelling, and Souki would leave the show empty handed.

I will ruiminate on the liklihood of TELL ever truly acheiving escape velocity as we close out this report. It really has no moat, being on the U.S. Gulf Coast its cargos will have to sail through the Panama canal to get to Asia. No worse or different than the other half a dozen LNG plants due to come on line in the late 20's. It does have one unique asset. Souki.

What's new?

TELL is beating the bushes for investors, and doing it fairly smartly in my view. Japan and India are both big consumers of LNG with an incentive to tie up new supplies on long term contracts. It's also no suprise that companies from these countries might become equity partners for discounted future supplies. We'll see.

The company also mentions in the press release they having coversations with oil operators, and I don't see the same pathway to fruition here. Oil companies are already deeply involved in LNG on their own, and exactly what TELL would bring to the table in that scenario escapes me.

The stock recovered a bit from recent lows on news that an investor had been found for a sale and leaseback arrangement on 800 acres of land. The remuneration for which came to a billion badly needed dollars. Companies like Bechtel don't take IOU's or equity. Cash on the barrelhead is what keeps them shoveling away.

Finally, TELL has filed with the SEC to double its common share float. At current share prices this will raise a billion or so, but dilutes current investors by half. There may be some squawking about this at their annual meeting in June.

Your takeaway

It's a grim picture, but not an impossible one. I actually think Souki may prevail with selling an equity position as part of an SPA deal. Right now we are covered up in gas, picking up 25 BCF last week, and putting us 18% over the 5-year average. But, the pendulum can swing. We are one-harsh European winter, or one-crazy hot California summer away sucking down the inventory substantially. It happens. But it may not. That's the beauty of this kind of investing. There's no predictable, rational basis, you just put your money down and watch the wheel spin.

TELL faces no liquidity crisis with a half a billion in cash on the books and little current debt. It can rock along like this for the foreseeable future. News that the company has been successful in pulling equity partners would give the stock a boost. A big boost probably. The company hit the $6.00 level mid-year '22. A tradeable event like an investor taking equity or a drawdown in supplies would be the catalyst for another upswing. It should be noted that Mitsui, the Japanese conglomerate just bought into the Eagle Ford in a big way, so Souki may in fact reel in an Asian whale.

The company is as a speculative bet as you can make, but in the low $1 range it's one that's paid off numerous times in this saga. That would be my suggestion if you're a Long-Shot Smitty and the muses are speaking to you on TELL. Get in low, and take profits immediately when you hit your target. Rinse and repeat as necessary.

Disclosure. The author has no position in TELL but may take one soon.

Disclaimer. Nothing I say in this article should be construed as investment advice. It may look or sound like it, but it is not. I am not a CPA/CFA and have no formal training/certifications/licences in either discipline. In these articles I present analysis and relevant information that an interested investors may find instructive. I may be bullish, bearish, or neutral and will discuss why, but I am definitely not recommending you buy or sell any security I discuss. Investors should always do their own due diligence before plunking down their hard-earned cash. They alone are responsible for their investing decisions.