Tariffs 101 And Negotiating: The Liklihood Of Tariffs On Mexico And Canada

The subject of tariffs on our two largest trading partners has aroused a lot of apocalyptic passion in government and business. We think most of this is overblown and explain why is this piece.

Introduction

There is a lot of conversation about tariffs and negotiating these days. I call this the Trump Effect. He’s had his ups and downs over the year, but is a pretty shrewd businessman in my book, and has negotiated deals all his life. Probably coming out on top of things more often than not. He even co-wrote a book about it. I read it years ago in the 80’s. It’s called: The Art of the Deal. It’s been updated over the years, and is worth a read even now as it gives some insights as to how his mind works.

I’m no Trump, but I know a bit about negotiating too. Schlumberger sent me to a week-long role-playing crash course in the subject to help up our game. Operators were just kicking our ass contractually, because we were trained to give away the store when we walked in the door. Our only metric was leaving with the order. That’s dumb, but it’s how the service industry thought.

You want a 20% discount on our current contracted price to keep the next 5-year service agreement from going out to bid? Sure. No problem. What else?

You want a global super-discount on annual sales? Sure. No problem. What else?

You want us to inventory three wells worth of products-(millions) with no invoicing until they are used? Sure. No problem. What else?

You want us to only charge rental on tools when they are actually in the hole? Sure. No problem. What else?

I could go on, but you can see how this mindset was just killing our margins. We were just going along with what they told us they wanted. What we found out was the operators had beat us to the punch and gone through this sort of training. We had a lot of catching up to do. And we did it. Until the downturn of 2015 came along. Then business collapsed all on its own…without any help from us.

But, that's not really what I want to address in this note. Sometime I'll put together a note on the negotiating and goal-alignment course I used to teach during my time as SLB's Global Trainer in RDF's and CF's. For now I want to discuss what I see as the natural outcome of tariffs.

What happens to domestic production when a good is tariffed?

The initial reaction is that consumers will see the price increases and that will lead to inflation. That can happen, but it's an over-simplified application of this economic tool. For reference, we had higher oil prices circa mid 2010's $80-90 per bbl, and inflation was in the 1-2% level, so there is no direct link between the two. In spite of what you may hear. FWIW I am firmly in the camp that the inflation we experienced a couple of years ago is much more closely aligned with the increase in money supply from the Covid era and the related logistics and supply chain kinks that had more money chasing fewer goods. That's not a huge leap for anyone with Econ 101 (hopefully) behind them. The structurally higher price regime we now live with is just waiting on a recession to restart price competition at the retail level. Your guess is as good as mine as to when this will happen.

Producer psychology in commodities is to seek the highest price they can get for their product. Tariffs set a floor price for a good in practice. Domestic producers rightly figure, if the market clearing price for oil is 25% higher than the NYMEX...hey they want that price too and it becomes the NYMEX price. This has the effect of restricting imports and increasing domestic production-and profitability. Don't believe me? Here is a scholarly take on what I've just described.

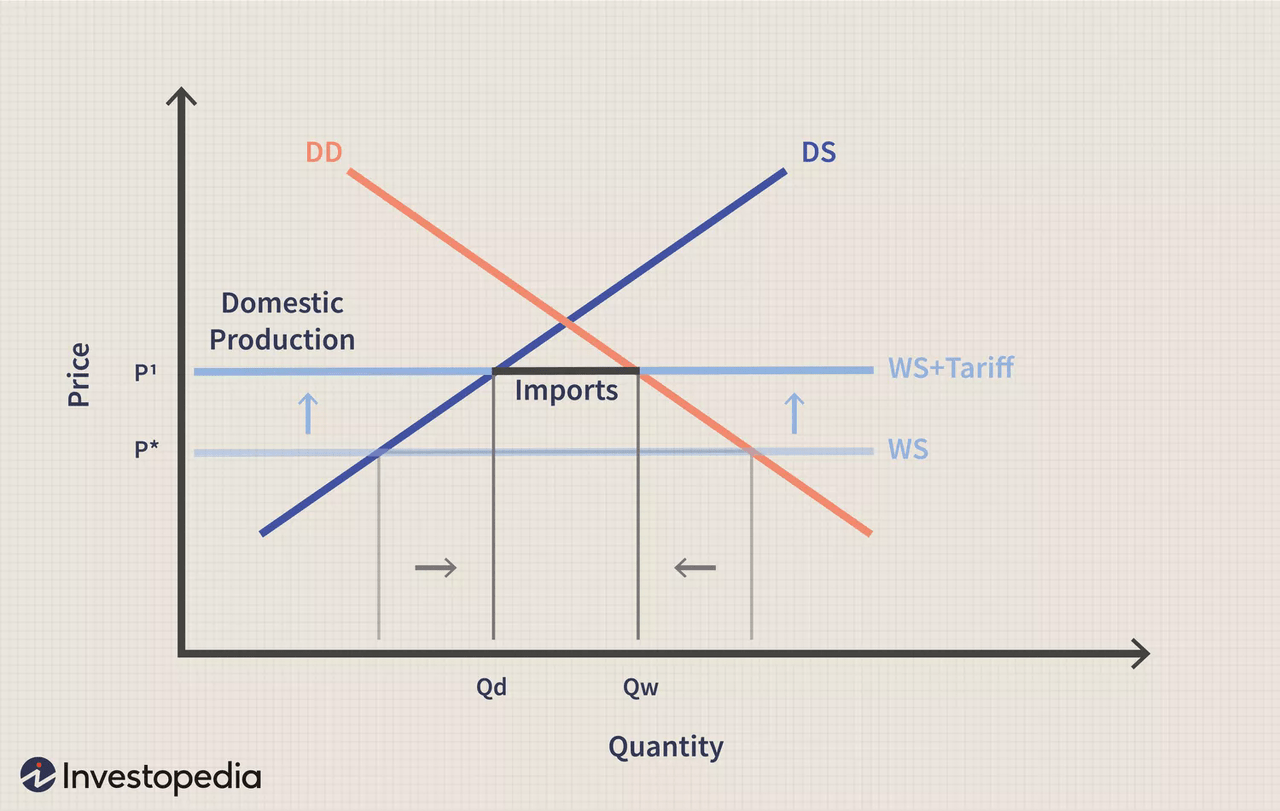

When a tariff or other price-increasing policy is put in place, the effect is to increase prices and limit the volume of imports. In the figure below, price increases from the non-tariff P* to P'. Because the price has increased, more domestic companies are willing to produce the good, so Qd moves right. This also shifts Qw left. The overall effect is a reduction in imports, increased domestic production, and higher consumer prices.

So tariffs would be very bad for Canadian imports if they were to be implemented. The reality is...they never will be. That would be nuts. My industry colleague and new Energy Secretary, Chris Wright will tune him up on this notion.

One of Trump's cornerstone election promises was to drive down energy prices by increasing U.S. production by 3 mm BOPD. I am very confident this will never happen as our key reservoirs are aging out and will begin to decline-you can only pour water out of a bucket so long, right? More gas and more water is the future of domestic energy production. We will move on.

Trump is using the threat of tariffs rather than having any intention of implementing them...unless Canada and Mexico fail to fall into line on the border. That's Trump's most visible deliverable and the set in his jaw when he discusses it tells me, "this is the hill..." Not going to finish that thought in light of the assassination attempts on him. But, "this is the hill."

And, its working.

Just the other day, the Mexican Army interdicted a huge cache of Fentanyl. This the same Mexican Army that's been absent for years on this front. New Mexican President, Claudia Sheinbaum has barely settled into her job and has to look like she's dealing with Trump on an equal to equal basis. In truth, the whole Mexican-non-drug, non-human trafficking, economy is based on exporting to the U.S. Oil, manufactured goods, and produce... most of it goes to El Norte. Behind the scenes, President Sheinbaum knows the jig is up and has been taking steps to come into compliance with Trump's demands. We are their largest trading partner after all.

Under US diplomatic pressure, Mexico has been conducting its largest ever migrant crackdown, bussing and flying non-Mexican migrants to the country’s south, far from the US border.

My view is tariffs will not be implemented on Mexico as they will meet key parts of the new immigration policy.

Then there is Canada. We get ~20% of our oil from Alberta, but the U.S. is that country's largest trading partner, so sales of other goods-lumber, cars is critical to their economy.

On Wednesday night, Trudeau held an emergency meeting with the leaders of the country's provinces and territories to discuss the tariff threat. Not only has Canadian PM, Justin Trudeau trudged down to Mara Lago to "kiss the ring," he has been busy at home.

On Wednesday night, Trudeau held an emergency meeting with the leaders of the country's provinces and territories to discuss the tariff threat.

According to a summary of the call, they were urged to "make use of all of their contacts, channels, and abilities to relay important information and messages to Americans and people of influence" about the deep economic and security ties between the US and Canada.

Uh-hunh. Accordingly, I expect Canada will do whatever it needs to avoid this outcome. Now China is another story. I’ll put some thoughts along those lines soon.

Your takeaway

I am not losing sleep about tariffs on imports from Canada and Mexico as I have discussed. If they occur at all, it will just be for a short time as our trading partners adjust to the fact that we have a real president again. Long term we need Canadian oil. If I am right about U.S. production having peaked and about to begin a decline, then we will need more of their oil. As such, current nervousness aside, I am not changing my investing strategy with regard to Canadian upstream operators.

Cheers, Dave