Select Energy Services: A Growth Story In Frac Water...Finally!

Introduction

Select Energy Services, (WTTR), is a leader in frac water management domestically. They have a solid business with years of running room, a nice cash hoard, and no debt. Did you get the "no" debt part?

So why have they underperformed the market recovery that began in November of last year and continued into January of this year? Capital restraint by operators is the key reason. The frac water market is smaller than it used to be and the market dislikes businesses, that have otherwise sound fundamentals, if market growth isn't a component. A shining example would be Tesla, (TSLA) where the market is willing to assign a multiple in the hundreds in return for growth. A multiple that has compressed in recent months.

In this article we will review the company's third quarter and make some guesstimates as to what Q-4 will bring when they report it. Several of the company's recent acquisitions are likely catalysts for near term growth. Longer term the company is broadening their service offering and improving their technology base. That means a return to growth could be just a quarter or so down the road. Let's investigate.

A word about water

Good ol' H2O. We all need it. Lots of it. The world over. Water management is a growing business. You don't really think about it... until the tap runs dry. And, then it is all you can think about.

The modern age can be defined as the event of widely available electric power and clean water. Without either you take a several hundred year step back in time, at a very rapid pace. And, you won't be happy there. Back-breaking labor hauling water, and disease from contaminated water are a daily part of your life, unless you are among the absolute upper crust-who has slaves or serfs to haul it for you. As is thirst from lack of water availability.

These are all problems the modern world has left behind. A sad statistic is that about 40% of the world's population still lives in this pre-modern age, and the challenge before us is to bring them closer to the developed world in water availability and cleanliness. I'm veering a little off topic here, so we will move on.

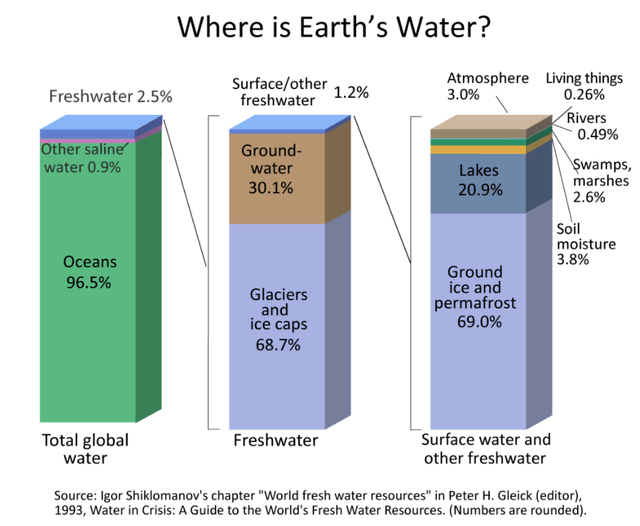

Source: USGS

Water is either in too much supply or is scarce seemingly. Think of those poor folks down in Fourchon who were devastated by Hurricane Ida (Please no global warming comments, the Weather Channel has me nearly catatonic with GW references every 90 seconds. thanks!). Then shift to the west where a third of the country is burning up (Same request here. The west burns up every year). Ida could have fixed that and moved a "ton" of water where it is badly needed. Instead, when she moved inland and drowned the northeast. Nature has its own way of allocating resources, and we just must adapt.

One of the big challenges facing modern civilization is the distribution and cleanliness of the fresh water supply. As the graphic above notes only 2.5% of the earth's water is fresh. New supplies must undergo expensive desalination processes. As we are learning, using fresh water for fracking is converting it to saline or brackish, and that's just got to stop.

Oilfield water-frac flowback and produced water has often been pumped away in disposal wells. That's a problem all its own as too much water, causes mini-quakes. An article carried on the Rystad blog notes the problems and the inefficiency of just sending it to disposal.

To offset the yearly growth of disposed water that Rystad Energy is forecasting due to the coming boom in the US shale industry, the volumes of treated water must increase from the 1.5 billion barrels seen in 2020 to 1.7 billion barrels in 2021 and 2022, 1.8 billion barrels in 2023 and then rise even further from 2024 onwards as the needs to dispose water will again exceed 12 billion barrels due to increased activity.

Rystad Energy estimates that by the end of 2022, the Permian Basin - including both the Delaware and Midland sub-basins - could be able to meet between 40% and 43% of frac water demand from recycled produced water. To meet this target, additional investment from the midstream space will be required to drive costs down further.

(Source: Rystad)

The thesis for Select

Frac water management will remain the core thesis for owning this company. Rigs continue to be added and at the rate companies drill horizontal, onshore wells these days, each rig probably translates to about 30-35 new wells annually. Last year the pace was about 11K wells, while the average rig count was about 350. That works out to 31 wells per rig, so we are in the ballpark.

The rig market is well above that average now and rising modestly. We expect continued modest gains, particularly in gas rigs in 2022 as rigs head toward 650 by mid-year and frac spread notch toward 300.

That is growth, and if you remember that every fracked well uses about 21 mm gallons of water, provides a lot of material with which to work. Much of this is recycled these days as technology to frac wells with modestly saline water has advanced considerably from the early days. We will discuss this further in the next section.

One final point. Select continues snaping up smaller companies in the water management space. On January 25th it was announced that the stockholders of Nueverra Environmental, (NES) had approved the all stock and debt assumption offer to acquire the company, valued at $45 mm. Nueverra’s assets will broaden Select’s footprint in the Haynesville, Bakken, and Marcellus plays. Additionally NES brings a solid waste managment segment in North Dakota, broadening the service lines.

With the broadening of their service lines discussed in the next section, we believe the thesis for Select is only enhanced.

Stuff I like

The Complete Energy Services acquisition for $14.2 mm in cash and $3.6 mm in stock, is complementary to their existing business and should be accretive immediately as they forecast. John Schmitz, CEO of Select comments on the Complete value proposition-

I am excited to have recently closed the acquisition of Complete Energy Services. Complete as a business I know very well and I believe that is a good fit with Select from both a service line and geographic standpoint. We are getting a strong market leading production service presence in the mid-con and the Rockies, a market leading water transfer footprint in the DJ basin and the Powder River Basin, and new key flowback customer relationships in the Permian Basin in the northeast. Add on to that we've acquired a sizable produce water infrastructure footprint with over 300,000 barrels per day of capacity. On top of operational and strategic benefits, this deal provides attractive and immediate earning accretion with more than $100 million of annualized revenue and $10 million to $12 million of annualized EBITDA expected in 2021. With more than 60% of that revenue coming from production related services and infrastructure.

The exposure to production is key here as it opens a door to post-frac stimulation services, and dove-tails with the UltRecovery acquisition we'll discuss below. Wells make water when they are on production and some of the equipment you see on a pad relates to BS&W-Basic Sediment and Water. The water has to be dealt with and if there is too much of it the well may not be commercially viable. There are two options then, P&A-Plug and Abandon, or a stimulation treatment of some kind. Most wells get multiple stim jobs before they are P&A'd. There are two levers here for Select. Water handling, and the stimulation chemicals.

There is also an opportunity in EOR, Enhanced Oil Recovery for Select as a result of the UltRecovery deal. If you follow the link, you will see that in this process chemicals, gases, and water are injected into the reservoir to drive residual oil to producing wells. As described above UltRecovery opens some doors for Select to participate in new business.

WTTR also participates in the fixed infrastructure business-recycling centers, pipelines, disposal wells, etc, and the oilfield production enhancement chemicals business. The first is fairly self-explanatory. Dig trenches, lay pipe and build recycling impoundments.

The second involves working with clients to restore reservoir flow characteristics and connectivity with the well bore using optimized chemistry. From my personal experience I can tell you this is area where "witch doctors" applying "voodoo" chemistry abound. Any effort to study the reservoir and match compatibilities with programmed operations is a step forward. And, that is what the company has done with its UltRecovery acquisition.

UltRecovery adds a new dimension to Select. When matched with their previous stimulation chemicals business it will be a powerful combination. This is a crowded space-everybody and his brother sells stimulation chemicals, sometimes known as "snake-oil". From the big colors who pump them, to Honest Bob the Used Car Salesman, you can buy acids, solvents, neutralizers, and surfactants from just about anyone. Your Aunt Susie probably has a side business peddling snake-oil to the oilfield, if she lives in West Texas. I'm being a little facetious here... but not that much.

The difference between pumping snake-oil down a well and delivering an engineered solution, is having the in-house ability to analyze the reservoir and test chemical technology designs prior to pumping. Along with the in-house formulary skill to come up with viable chemistry based solutions to real world problems. it is also where you build profit into these basic commodity chemicals. Experienced people make all the difference.

Success in this effort, along with focused client support gets you a rep. A good one, and customers come back and pass the word along to their colleagues and associates, that you are the real deal. I'm not kidding, I've sold stimulation chemistry and there is a way to do it properly. Having the in-house ability and the personnel to advise clients takes WTTR to a new level.

John Schmitz comments on the impact of the UltRecovery acquisition-

On top of operational and strategic benefits, this deal provides attractive and immediate earning accretion with more than $100 million of annualized revenue and $10 million to $12 million of annualized EBITDA expected in 2021. With more than 60% of that revenue coming from production related services and infrastructure; we are also adding an attractive layer of revenue stability to our core completions oriented based businesses. We anticipate revenue and costs synergies resulting from this transaction, but we will be deliberate about how we approach the integration in the coming quarters.

Select has also closed on the water infrastructure division of Basic Energy Services, AguaLibre. This will enhance their business base in their core Permian base operating theatre, and add new revenue from the DJ and Arkoma basins. Schmitz discussed expectations in the call-

I believe the acquisition of Agua Libre provides similar financial, strategic and operational advantages. Overall, with Agua Libre, we believe we've added $70 million to $80 million of annualized current run rate revenue and $6 million to $8 million of annualized current run rate adjusted EBITDA with meaningful room for operational improvements, cost synergies and high ROA growth.

So far so good. Select has a ton of money sitting on their balance sheet. With no debt to service, modest capex for maintenance, and no dividend to pay, it should be put to work. Select's proper role is as a business aggregator and it inspires confidence in current management that they are filling this niche. John Schmitz comments on the impact of Select's recent acquisitions and view toward additional opportunities-

Ultimately, I'm very excited about our recent M&A execution, our recycling projects and our other sustainable mobility focused investments. I also firmly believe we will continue to find additional opportunities ahead. With growing activity, stable commodity prices and improved operational and financial performance in the third quarter and end of next year, the future remains exciting.

As a final note on this section, I would note these acquisitions bring hundreds of trained and highly skilled people into the fold. And, at a time when talent is at a premium.

The Big Idea

A quick word on the recycling projects Schmitz refers to, and is the Big Idea I referred to in the title. Recycling is the key to future frac water supplies as noted in the Rystad article. Select has gotten contracts from two operators in the Midland and Delaware basins to build large volume permanent recycling centers. They have an additional three-3, centers on the boards for completion in 2021. Schmitz comments on these recycling centers-

They are supported by long-term contract with key customers, which reinforce the strengths of Select's platform to provide integrated solutions that rely on our expertise in water and chemistry. These projects not only increase efficiency, reduce costs and improve operational results for our customers, but they also help our customers achieve their sustainability goals and ESG targets by reducing their environmental impact through decreased freshwater usage and decreased waste disposal.

As I noted in describing the water conundrum in the previous section, fresh water is precious, and it is imperative that the oilfield use mostly recycled water in fracking. The recycling centers are a big step in the that direction.

Also in Q-3, Select reported an additional recycling center contract in the Rockies-

We were recently awarded a 3-year take-or-pay contract to build, own and operate a produced water recycling facility for a major integrated oil and gas company in the Rockies region. We commenced construction on this produced water recycling facility late in the third quarter of 2021 and expect it to be fully operational in the first quarter of 2022.

This facility will support the recycling of up to 15,000 barrels of water per day with the ability to expand up to 30,000 barrels of water per day. This facility will be connected by pipeline to an existing saltwater disposal well owned and operated by Select. We believe this connection to our existing disposal infrastructure provides meaningful optionality and flexibility for our customer.

A new ESG angle for Select

The partnership with EmissionsRx, perplexed me honestly, until I visited with their IR department. Controlling wellsite emissions ticks a very visible box for the oilfield as we are being pressured to reduce emissions of all types.

An initial contract was noted by Schmitz in the Q-3 call-

On the emissions reduction side, since signing our exclusive distribution partnership with Emission Rx during the second quarter, we recently received our first delivered methane combustor unit during the third quarter. We quickly deployed this to our first customer. And we have 5 additional units on order that we expect to receive and deploy during the fourth quarter.

To remind everyone, these Emission Rx solutions are designed to help control, reduce and ultimately eliminate methane and other waste gas emissions during the flowback and production phase of a well.

Emissions are top of mind these days, from government entities to corporate boardrooms, and Select has tapped into a viable pathway to help client manage this problem.

Q-3

The company missed analyst estimates on the bottom lines, but beat on the top. Revenue of $204 mm showed an increase of 27% QoQ. Water services and chemicals enjoyed strong quarterly growth of about 47%, with margin improvement to 16%. Water Infrastructure was up 10% to $37 mm. For the third quarter the company had expected a strong rebound in this segment, guiding to growth of 20-30% and gross margins in the mid-20 percentile. This was missed due to client scheduling and the company predicted this margin growth would show up in Q-4. Chemicals were up 8% to $55 mm.

Free cash was $18 mm negative in the quarter due to networking capital adjustments and capex for recycling centers. The company finished the quarter with $107 mm in cash, and total liquidity of $232 mm. The company has no borrowings against its RCA.

Risks

At $7.00 and change, the company has minimal risk in this environment. Short of an earnings restatement or some other catastrophe, there shouldn't be much downside. The market is very supportive as we have discussed. The universe is a contrary place however, and anything can happen. You have been cautioned.

Your takeaway

What to expect for Q-4. We won't see revenue from the recycling centers yet, or Aqualibre, but we should see incremental growth from the Complete Services deal along with growth in the frac water and chemicals business consistent with the rig count increase. If you take that $204 mm 27% revenue growth for Q-3 as a base line, add in a 55 rig increase x their market share-estimated at about 30% in the Permian area at least, add in a fudge factor for Complete, and you can come up with revenue in the $240-260 mm range for the quarter. This should continue rising through the year if the rig count implications of recent production growth announcements of ExxonMobil, (XOM), and Chevron, (CVX) are a guide.

That's growth that will likely be rewarded by a higher earnings multiple. WTTR was trading at 2X annualized adjusted price to sales ratio for Q-3, but the share price has risen 25% since the last review. If revenues come in where I project that ratio would drop to <1 at current pricing, and that’s too low for a company experiencing their rate of growth. If we just get back to the 2X level on earnings release Select should sport a share price of $15, a doubling from present levels. I think it has catalysts to move higher through the year with rising revenues from the increase in activity.

Disclosure. The author has no position in WTTR, but make take one in the next 72 hours.

Disclaimer. Nothing I say in this article should be construed as investment advice. It may look or sound like it, but it is not. I am not a CPA/CFA and have no formal training/certifications/licences in either discipline. In these articles I present analysis and relevant information that an interested investors may find instructive. I may be bullish, bearish, or neutral and will discuss why, but I am definitely not recommending you buy or sell any security I discuss. Investors should always do their own due diligence before plunking down their hard-earned cash. They alone are responsible for their investing decisions.