Welcome to this inaugural post in the Energy Investor’s Research If you’ve arrived here then there is a good chance that you are interested in profiting in the energy sector. That puts us in perfect alignment, as it is my goal as well.

Since my retirement from Schlumberger a few years back, I’ve been teaching and writing on energy topics. One of things I’ve found that people are most interested in is the direction energy prices, primarily oil and gas will take in the coming year. Now, let’s be clear, I don’t make prognostications with firm price targets. If I did that I would expect you to stop reading and delete this site from your computer. Too many drivers-geopolitcal, weather, public company or national oil company financial objectives, interest rates, exchange rates, and many more, impact oil prices to do this with any certainty. What I do is analyze data from public and private sources and identify trends that may well drive these prices in one direction or the other. Knowing this trend, reveals companies that may stand to profit or suffer in either scenario. You can make money on either end of this spectrum, with just a little advance notice. That’s my job.

Petroleum energy is a cyclical business. Scarcity of supply generally drives increases in production seeking a higher price regime. Conversely, plentiful supplies depress prices, and tend to lower production as incentives for producers decline. A lot of the focus for this site will be on companies (E&P’s) either exploring and producing energy, or on companies-OSV’s that support this effort with products or technology.

Oil prices have pulled back from October highs primarily from concerns about the new Covid variant leading to renewed shutdowns that would dampen demand. A stronger dollar, and recent inventory builds have further weakened the push that WTI and Brent sustained into early November, in spite of demand staying strong during this time. As we close out the year we are seeing inventory draws and the news on the Omicron variant isn’t is dire as first suspected.

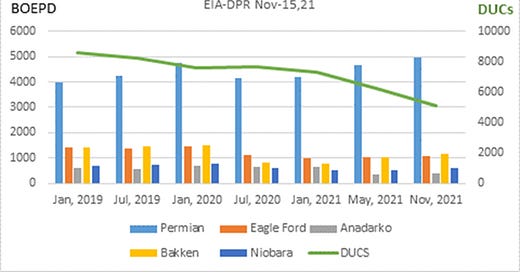

My expectation for oil and gas prices is to sustain the range they have established in the second half of this year. High $60’s to low $80’s, for WTI. Natural gas has probably peaked, unless weather patterns change in North America quickly. Oil companies have no particular incentive to ramp up drilling as they are making so much money at these prices, they literally don’t know what to do with it all. Shareholder incentives-stock buybacks and enhanced dividends are a symptom of this scenario. Production is likely to fall in the U.S. as we move into 2022 due to DUC-Drilled, but Uncompleted wells activations falling. The current level of +/- 8.2 mm BOP/D has been sustained this year by DUCs coming on line. This is nearing a tipping point, and companies will have to pick up more rigs to maintain current output. There are some unknowns as to the decline rate of existing wells. Technology has played a big role in increasing production in the last couple of years. Regardless, by mid-year or toward the exit of 2022 drilling will have to increase to maintain output.

EIA-DPR/Chart by author

One theme that we expect will begin to dominate the water-cooler chat is the coming scarcity of energy. Under-investment in upstream sources by nearly half a trillion dollars over the last decade has created a scenario where demand will outstrip supply in the coming years. That will certainly have an impact on some of the companies we will be covering in this blog.

Now in the interest of being blatantly honest, I think “green energy,” renewable energy is full of flaws, some of which are becoming apparent. I think other flaws will come to the surface in the coming years. I am not questioning the move to renewables. It’s going to happen, and is underway on a massive, multi-trillion dollar scale even as I write these words. My view though is the pace of this move has outstripped the underlying thinking that must take place in order for renewables to be a reliable force in the energy transition. In short, too much is happening, too fast. I see problems ahead, and will point them out in my writing. That is not to say there isn’t money to be made in this sector. When appropriate I will feature companies with strong prospects in renewables.

Now, this is a financial blog. I will back up my writing with detailed analyses of company filings that enable us to determine dividend sustainability, liklihood of stock buybacks, liquidity and other financial metrics that establish investibility.

In tomorrow’s discussion we will feature the investibility of a major European oil company. Many energy writers are heavily promoting this company on a valuation basis. Are they right? We will discuss tomorrow.

Thanks for subscribing and reading. Cheers, Dave