Liberty Energy: Quality On Sale After A Strong Q-1, 2023 Report

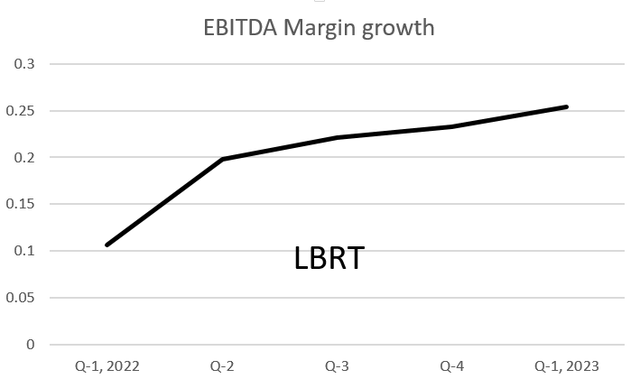

LBRT has maintained pricing power and moved EBITDA margins consistently higher

Introduction

Liberty Energy, (LBRT) turned in a very solid quarter for Q-1, beating on the top and bottom line, and showing 60% growth YoY. The market had not be prepared for this and had been taking down EPS estimates for the past several months. As investors we love good surprises and that certainly was one, as the stock has been mercilessly hammered in the intervening time.

I think LBRT is a stock you want to own at current levels. It is the number two overall, and number one of the pure-play frackers. It has more going for it than just the business fundamentals we normally judge companies by.

It has founder, Chris Wright in the CEO seat, and if you believe management makes a difference, you are a fan of his. Wriight is a visionary with a practical side. Wright is also the brainiac who essentially invented real time frac modeling-something we take for granted now, with his first start up, Pinnacle Technologies, sold it to Halliburton, waited out his non-compete and then founded Liberty. Wright is an enthusiastic and well-known supporter of a rational approach to energy delivery and frequently makes the round of financial chat shows, speaking about it in addition to running LBRT. I have published some of his writings here in the DDR, and he has taken recently to doing podcasts. Here's a link to some of them, have a listen. Wright is an engaging and passionate advocate for sensible energy policies, and I think you will find listening in worthwhile.

The thesis for LBRT

This section will be pretty short. I went into a lot of detail in the original LBRT article explaining why drilling and completions activity has to be maintained in shale, and I don't have a lot more to say regarding the macro for shale frackers. LBRT is the second largest in terms of revenue and HHP, operating an estimated 44-45 fleets, with 39 under contract in Q-1. LBRT covers the full gamut of fracking with its acquisition of last mile sand logistics specialist, PropX in 2021. It is basic in sand with two mines that came along with the SLB deal to take over OneStim.

Fuel sources for frac spreads is a constant topic as a Tier II diesel spread burns millions of gallons of diesel annually. The conversion of the diesels to Tier IV Dynamic Gas Blend-DGB, DigiPrime and all-electric Digifrac units is well underway-at the 50% point now, and soon will comprise the bulk of LBRT's fleet. Now Liberty has formed a vertically integrated subsidiary to supply fuels-CNG, RNG internally and potentially to other frac companies.

Liberty Power Inc-LPI, will use newly acquired Siren Energy's CNG, technology to grow this business. CEO Wright describes it thusly-

To accelerate LPI’s expansion earlier this month, we announced the acquisition of Siren Energy, a Permian-focused, integrated natural gas compression and CNG delivery business. Siren brings its installed and expandable gas compression facilities at two Permian sites together with transportation, logistics, and well site pressure reduction services.

I am sure we will hear more about this business in quarters to come. It's smart move by LBRT, sort of a "Midstream" solution to how to get reliable power to Tier IV DGB frac pumps, and I think it will quickly become accretive to the company. See what I mean about Wright being a visionary?

Q-1 and 2023 guidance commentary

Revenue came to $1.3 bn, flat sequently but up 60% YoY. Adjusted EBITDA came to $330 mm, a 12% gain sequentially and over 3X YoY. The company returned $81 mm in capital to shareholders, consisting of $75 mm in stock buybacks and $9 mm in dividends. Net debt stood at $211 mm, and there was $21 mm cash on the books. Total liquidity stands at $300 mm including availability on their ABL. Over the past year LBRT has reduced its share count by 4.5%.

CFO Michael Stock closed out his commentary with guidance for the year-

Looking ahead, we're expecting modest sequential growth in the second quarter, expanding on the solid results, we achieved in the first quarter and reflecting stable pricing, normal, seasonality, and a solid base of customer demand. We're not seeing softness in the gas markets significantly impacting our second quarter results.

Risks

LBRT is a well-managed company with little debt and an industry leading position in the pure-play fracker segment. It has shown the capacity to make market concentrating acquisitions that are quickly accretive, and with the introduction of LPI is vertically integrating its fuel supply needs. This should drive down fuel costs and bring in revenue as its customer base expands. The main risk to the thesis lies in lower oil prices than the industry expects this year.

Your takeaway

On April 27th, Liberty was the subject of a bullish article in Morningstar written by Katherine Olexa. She writes-

In our view, most of Liberty’s first-quarter performance is attributable to favorable pricing rather than active frac spread count. Estimates from Rystad Energy indicate Liberty operated 39 active rigs, four less than last quarter. Yet, first-quarter revenue increased 3% sequentially, implying service prices jumped 15% by our estimate. Pricing gains continue to boost profitability as well. For the third consecutive quarter, firmwide adjusted EBITDA margin increased 200 basis points to 26%, well above the firm’s prepandemic average in the high teens.

Ms. Olexa goes on to put a near term price on Liberty share of $17. Other analysts are calling for a range of $14.50 to $28.00, with a median of $19.50.

Right now the company is trading at 1.8X Forward EV/EBITDA. Analysts have been raising their EPS estimates for Q-2, and are currently forecasting $0.96 per share. That would put earnings at $173 mm for Q-2, slightly ahead of Q-1's $163 mm. With that in mind we can nudge EBITDA for Q-2 to $350 mm run rate, put a 2X on it (181 mm X $17.00 = $3 bn market cap) and handily attain Ms.Olexa's $17.00 price target. If we hang a 2.5X on LBRT we get that median estimate of $19.50 per share.

For reference, smaller competitors, ProPetro Holdings, (PUMP) and NexTier, (NEX) are trading at 2.6X, and 2.43X respectively. None of these companies are overpriced in this market, but LBRT is our pick.

However you calculate it, LBRT is in a buy zone at the present time and risk tolerant investors should take a hard look at the company.

Disclosure. The author is long LBRT.

Disclaimer. Nothing I say in this article should be construed as investment advice. It may look or sound like it, but it is not. I am not a CPA/CFA and have no formal training/certifications/licences in either discipline. In these articles I present analysis and relevant information that an interested investors may find instructive. I may be bullish, bearish, or neutral and will discuss why, but I am definitely not recommending you buy or sell any security I discuss. Investors should always do their own due diligence before plunking down their hard-earned cash. They alone are responsible for their investing decisions