Halliburton: Big Red Busts A Move, I'm Not Chasing It

Long term I am bullish on the company and explain why. That said we need some direction from the market right now. Hally is a hold.

Introduction

Halliburton, (HAL) turned in impressive results for Q-4, 2022, to no one's great surprise. It did many of the things companies do when they have a great quarter. They increased their dividend and bought back stock. Two moves of which I approve as a shareholder. One, I like it when the company gives me part of my money back. Two, I am on board with the stock repurchase as well, unlike Chevron, (CVX) which is buying back stock at all time highs, HAL is nowhere near its all time high, somewhere in the $80's.

In this article we will hit the highlight of the Q-4 call and discuss what we think may be catalysts to propel the stock higher as the year goes on.

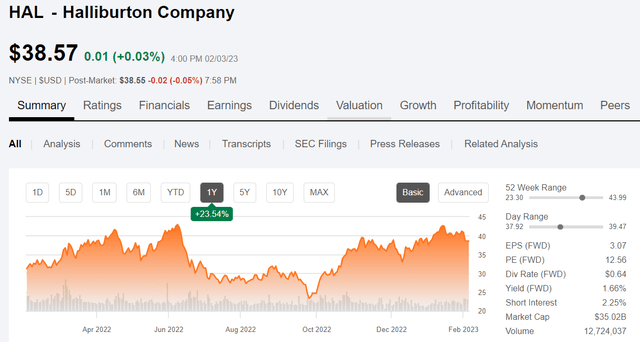

The professional analyst class is unequivocally high on the company with buy ratings, and price forecasts that range from $40 to $58 per share. The median price is $50, revealing the bulk of the analysts are rating the company as a buy. $50 gives us a potential 24% upside from the current level, and I think is a solid bet for the year I see shaping up.

The buy thesis for HAL

HAL performs essential services for oil companies related to drilling wells, evaluation of the formation, well completion, and the eventual production of hydrocarbons. As we have pointed out repeatedly, service companies are set to benefit from an increasingly intense reinvestment cycle that is still in its early stages.

Simply put oil companies have no choice but increase spending on new production, if they want to remain in business-that is. You can probably imagine the effect BP's announcement the other day, that they "just weren't making all that much money in renewables," had on me. My sides still hurt from laughing. The cash flow that comes from oil prices in the $80-$90 range is so prodigious, that even after funding variable dividends, stock buybacks, and paying down debt, there is still money left to fund upstream capex internally. You see that with ExxonMobil, (XOM), and Chevron, (CVX) pouring billions into the Permian to raise production.

If my friend Arjun Murti and I are right, it's just the tip of the iceberg, so to speak. You have seen this graph before, but memory fades, so here it is again. It shows that we are just emerging from the absolute depths of the lows of 2020 in terms of ROCE-Return On Capital Employed. While oil prices have doubled and spiked to 4X their 2020 lows, ROCE for service providers has barely entered its upcycle. Using the Arjun's graph below, ROCE has the potential to double to 10% from its current 5% at $80 oil prices.

Two catalysts for Hally in 2023

I've repeatedly made the point that Tier I acreage is getting scarcer, and some of the posts I put up in chat yesterday support that contention. We have also discussed the fact that laterals are getting longer. What do those two things mean for Hally?

A couple things stand out. The company is #1 in pressure pumping-by a long shot, and #1 in Directional Drilling, edging the nearest competitor Baker Hughes, (BKR) by a few percentage points. Longer laterals are obviously impact pressure pumping-fracking. Pumping is sold by a number of buckets. The first bucket is the daily rental for the equipment. The next is bucket (and this is the biggie) is the number of stages pumped. Longer wells mean more stages and more revenue for the company. Technology plays a big role in Hally's market leadership. Jeff Miller comments on Hally's cutting edge Zeus efleet-

We see strong demand for our Zeus e-fleets with several repeat customers contracting additional fleets. Zeus is a proven design with a strong operational track record. Our new automated fracturing platform, Optiv, fully automates equipment operation, reduces maintenance and extends component life. We are in the early innings of this rollout, having proven it over 15,000 stages, and I expect it to drive higher capital efficiency.

Now let's relate what longer laterals and lower quality acreage mean for the directional category. In my active OFS career I typically worked on wells that had 1,000-1,500 meter HZ sections, but that was the dark ages and it was offshore. (Offshore wells are in sandstone or carbonate reservoirs, and you don't have to go as far laterally as you do in shale.)

One of the reasons oil companies pay big money for high tech MWD-Measurement While Drilling, and LWD-Logging While Drilling BHA's-Bottom Hole Assemblies (These can be a couple of stands-2-3 joints of pipe long, so we don't call them bits. The BHA has a "bit" obviously, but there's a lot of other kit being sent downhole with it.) It was difficult-hard shaley streaks/ faults/facies change, to keep the BHA in the reservoir and engineers relied completely on telemetry to assure them this was so. (Yes of course, there was a mudlogger at the surface looking at cuttings as they came across the shaker, but that is a couple of hours after the fact. Drillers need to know where the BHA is in real time. Hally refers to their flagship entry in the MWD/LWD segment as iCruise with its companion iStar logging assembly and notes that it is currently drilling 70% of their footage worldwide.

I think their market leading position in this category as tougher, longer wells are drilled is a catalyst for growth in domestic and international markets in the coming year. Reliability is also a big factor and Hally's dominant position here tells me that they aren't making a lot of surplus BHA trips-(what you do when telemetry fails, the MWD/LWD hand's worst day on the rig. He's ( I am saying "he" but let's understand there's a crew out there that includes women) got to get the replacement BHA made up and racked back, ready to swap out when the failed BHA hits the rotary table, then he's got to do diagnostics on the failed assembly to see if it can be rebooted, or get a new one helicoptered/trucked out from town. It's long day that typically runs into the next day...and to put the icing on the cake, everyone is mad at you.). Jeff Miller comments on the full year impact of the D&E segment on results for the year-

The Drilling and Evaluation division generated full year operating margins of 15%, an increase of 320 basis points over 2021. The steady expansion of D&E margins demonstrates the global competitiveness of our D&E business.

Source

It should be noted there's a lot of competition for MWD/LWD work, so there are limits to what Hally can charge.

The next catalyst is Hally's increasing footprint internationally. Many of the Middle East countries that makeup OPEC-Saudi Arabia, Qatar, Oman, UAE, Iran, Iraq, and others have announced multiyear plans to either up their output or replace played out fields. Combine this with MEA countries not members of OPEC, but with plans to vastly increase production- Egypt, Israel primarily, and you have a fertile field for Hally in the coming years. Jeff Miller comments on the international outlook-

International revenue grew 20% year-on-year with strong growth and margin expansion from both divisions. This gives me confidence in the earnings power of our international strategy. In 2023, we expect international activity to grow at least mid-teens with most new activity coming from the Middle East and Latin America. As this up cycle continues, I believe that we will see substantial growth in all international markets, both onshore and offshore, led by development activity and increased spend at the wellbore.

Q-4, 2022 and guidance for 2023

Total company revenue for the quarter was $5.6 billion, a 4% increase over the third quarter while operating income was $976 million, an increase of 15% over third quarter operating income. Operating margin for the company was 17.5% in the fourth quarter, a 460 basis point increase over operating margins in the fourth quarter of 2021. These results were primarily driven by increased global activity, pricing and year end product and software sales.

Segment results

Completion and Production revenue in the fourth quarter was $3.2 billion, a 1% increase when compared to the third quarter, while operating income was $659 million, an increase of 13% when compared to the third quarter. Despite weather related downtime late in the year, C&P delivered an operating income margin of 20.7%, the highest operating income margin since 2012. This was due to improved pricing, service efficiency and activity mix in North America land as well as increased activity in international markets.

Drilling and Evaluation revenue in the fourth quarter was $2.4 billion, an increase of 8% when compared to the third quarter, while operating income was $387 million, an increase of 19% when compared to the third quarter. These results were driven by higher year end software sales and an uptick in international activity. Operating margin increased 210 basis points above Q4 2021.

International revenue increased 9% sequentially due to solid year end sales, pricing gains and activity increases. In North America, revenue in the fourth quarter was $2.6 billion, a 1% decrease when compared to the third quarter. This decrease was primarily driven by weather related downtime in North America land. Latin America revenue in the fourth quarter was $945 million, a 12% increase sequentially due to higher activity in Mexico and across the region. Europe/Africa revenue in the fourth quarter was $657 million, a 3% increase sequentially driven by higher completion tool sales, drilling activity and well intervention services across the region. These increases were partially offset by lower activity in Norway. Middle East/Asia revenue in the fourth quarter was $1.4 billion, a 10% increase sequentially, primarily resulting from higher software sales and drilling and evaluation services across the region.

Capital expenditures for the fourth quarter were $350 million with 2022 full year CapEx totaling approximately $1 billion. Turning to cash flow. For the full year, Hally generated $2.2 billion of cash from operations and delivered approximately $1.4 billion of free cash flow. Hally ended the year with approximately $2.3 billion in cash.

They expect to return a minimum of 50% of free cash flow to shareholders in the form of dividends and share buybacks. Hally increased the quarterly dividend by 33% to $0.16 per share, effective with a dividend payment in March 2023. Also in Q-4, they repurchased $250 million of shares and and authorization of approximately $5 billion remains.

Guidance for 2023, Q-1

Completion and Production sequential revenue to be essentially flat with the fourth quarter while margins will drop between 75 and 125 basis points. In our Drilling and Evaluation division, we expect revenue to decrease in the low to mid single digits sequentially while margins are expected to be down 25 to 75 basis points. This is primarily driven by season weather issues in North America.

Risks

The oil price presents the chief risk to the company on a short term basis. We have seen this as the oil price fell from the $90's to the low $70's and took Hally down with it on the way. If oil were to break $70 to the downside for any length of time, the company could revisits September 2022 levels-$23ish.

Long term if my thesis about shale productivity diminishing is borne out, Hally will have the wind at its back. That's the bet I am making.

Your takeaway

Hally is trading at a relatively high cash flow multiple of 8.8X. While I am bullish about the company's prospects for the year, I am not going to chase it at this level. If we get a dip back into the $20's, which is not out of the question given the rig count drop the last few weeks and their fairly dour guidance for Q-1, I would add.

Longer term, later this year I think comparables will propel the company higher, perhaps toward those rosy analyst estimates in the $50's. But, we have some ground to cover before that happens.

Right now Hally is a hold for me.

Disclosure. The author is long HAL.

Disclaimer. Nothing I say in this article should be construed as investment advice. It may look or sound like it, but it is not. I am not a CPA/CFA and have no formal training/certifications/licences in either discipline. In these articles I present analysis and relevant information that an interested investors may find instructive. I may be bullish, bearish, or neutral and will discuss why, but I am definitely not recommending you buy or sell any security I discuss. Investors should always do their own due diligence before plunking down their hard-earned cash. They alone are responsible for their investing decisions.