Greetings all. I am relaunching this blog with this post from my paid service on Seeking Alpha. I will be posting here once or twice a week. I hope you find it useful and informative. Feel free to share.

Introduction

Well the U.S. Iran talks drag on and will soon fade into irrelevance in my view. The mullahs have black belts in this sort of "diplomacy," and have an unbroken track record of wearing successive U.S. administrations down-to the point, where they strike awful deals that let the country continue to enrich uranium. The point we seem to be at now. But, sleep well...more talks are planned.

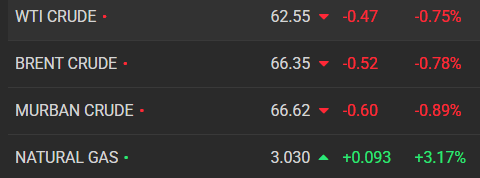

Talk of tariffs continues and is probably what weighs on the oil market this AM. The WSJ had a good summary (unlocked) of the paralysis gripping the markets now in the paper yesterday. How do you allocate capital in this environment? The WH appears to be calming the markets today with talk of impending deal announcements. What we said last week still applies-get it done.

To calm the market we need a big, beautiful deal. Some tangible sign this strategy is going to play out as government financial leadership-Bessent, Hassett, Lutenick, and Navarro anticipates. That and the tax package we have all been promised comes to fruition. Not either or, both must happen before we see risk on return. There are hopeful signs, but it would sure be good to see a victory lap.

We have seen some resilience around WTI in the $60ish range. That may be more hope than substance, so expect more volatility. Two things could alter the short term arc this week. Any sign of a fall off in shale production in the EIA-914, and or any sign OPEC+ may pause on their own. The WSJ discussed-

BNP Paribas’ head of energy strategy Aldo Spanjer. Following reports that Kazakhstan will prioritize national interests over compliance with production quotas, BNP doesn’t expect the country to cut output to compensate for overproducing. This could also lead to a larger OPEC+ supply hike in June, contributing to near-term weakness in the market. “We see this as the largest bearish driver in the market, with the risks to OPEC+ unity growing,” Spanjer says.

There ya go.

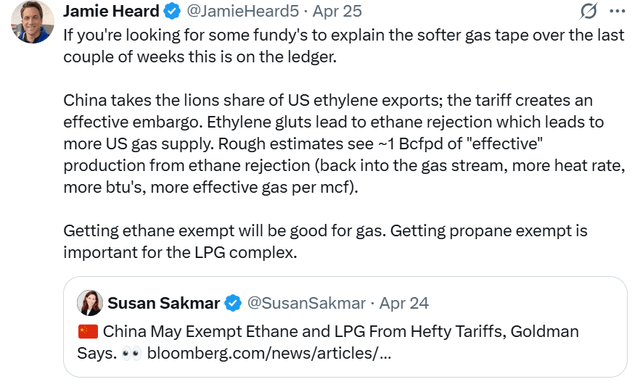

Gas has weakened quite a bit as well but remains at a pretty strong price, relatively speaking. Does the onset of spring cooling demand, LNG exports, and AI data center demand keep us on track for better prices being sustained YoY? We are still about 600 BCF lower than this time last year!

WTI seems to be reacting to negative or no-good, tariff news. Will maximum pressure on Iran overcome the restoration of cuts by OPEC+. Those seem to be the swing factors at this stage, although if we have an inventory draw this week, traders are going to sit up and take notice.

The ten year T-bill is 4.28's% as we slog through the day's trading, down a few basis points WoW.

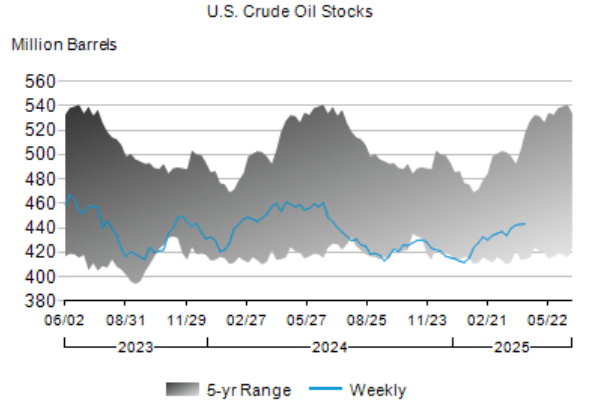

A .2 mm inventory build last week put us back on the normal seasonal upward trajectory. Gasoline stocks dropped by 4.5 mm bbls, and distillates dropped by 2.0 mm bbls. Demand looks pretty good as the warm weather driving season begins.

The graph below shows a similar structure to last year at this time-a sidestep before continuing higher, albeit at a lower level. At 443.1 mm bbls, we are well below where we were last year by about 17 mm bbls or so. Last week wondered if we were going to head higher as we head toward May it becomes increasingly less likely we hit last year's peak of 460 mm bbls.

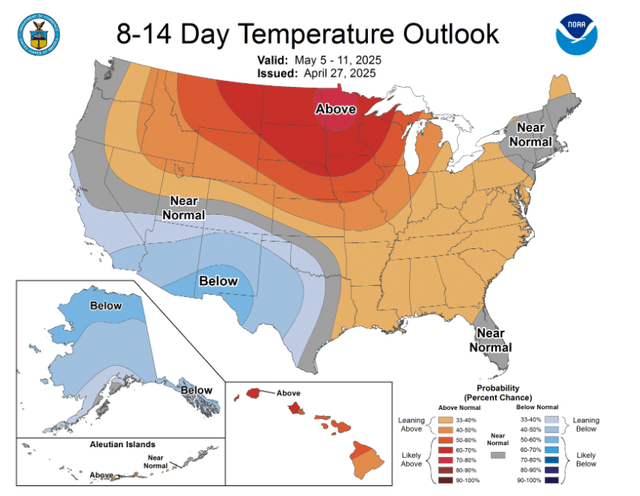

Here in late-April the warm up continues over the western half of the country and warm and wet over much of the country.

Oil drillers picked up 2 net rigs last week. Oil rigs were up 2 to the 483 level, and gas rigs rose 1 to the 99 level. 5 more frac spreads went back to work last week, according to PrimaryVision, bringing the total in the field to 205. Could we be bottoming out? Perhaps, but there is no catalyst for much of a rally right now. Perhaps gas drilling may form the basis for a rally as noted by Ron Gusek in the LBRT report.

DDR Portfolio Monthly Update for Apr-1, 25

To be updated for first full week in May.

Crack spreads have moved higher recently now standing at at-$27ish. A near 60% rally since the first of the year! Refiners should be singing and dancing. But they're not-PSX, VLO, DINO-all down 40-50% YoY. This bears looking into.

Quote of the week:

The Nuttall Nugget- Gives way to Jamie Heard today from X. This is the best explanation I've seen for the recent softness in gas.

Themes check-in-

Shale/GOA-looks like shale companies may be tightening their belts in the near future. Irina Slav notes shale M&A is about half the pace of a year ago.

LNG-exports to China continue under suspension this week. Hasn't hurt Cheniere as yet.

Gas- Weakening week over week, but hanging in the low $3's. That's good money for most gas drillers.

Low Cost Canadian shale/heavy oil, Conventional- So let's face it most of the Canadian E&P's are in for an ugly quarter. With WTI near $60, few of them are in the black when the WCS discount is factored in. Brace for impact.

Commodity Lookahead

More and more I think the trade war market driven volatility keep a lid on any good news in oil prices. Will the Saudis follow through with their plans to raise output? Will we fall see a real decline in shale output. Some sign that the indications that top-tier inventory exhaustion may be on the horizon.

Potential Catalysts for the current week-

Monday- Nothing much today.

Tuesday- Big day-Retail Inv, Whsle Inv, Consumer confidence, Case Shiller, and Job Openings

Wednesday-ADP number, Q-1 GDP, PCE, and pending home sales.

Thursday- Initial Jobless claims, ISM, Construction spending, and Auto sales.

Friday-Unemployment rate, Factory orders.

The dollar gaining WoW, starting the week at $104.28 this week.

Stocks of the week

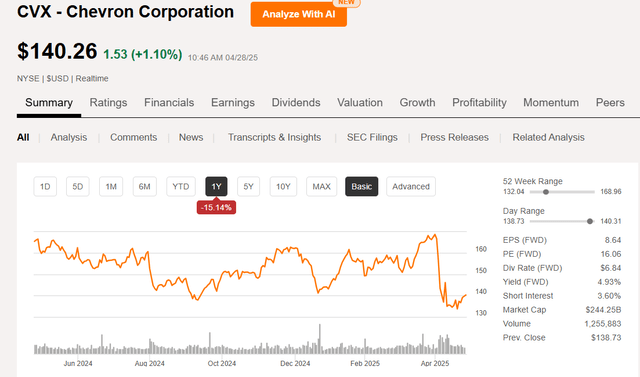

We didn't get to Chevron, (CVX) last week, so it rises to the top this week. It's had a pretty good bounce WoW. Is that justified? One thing that could be driving the stock now are expectations for a favorable ruling on Hess. Recently it took a 5% stake in the company as a sign of confidence in the outcome. We will do some digging here.