Just a quick note. I have fallen way off in posting here. Some of this was due to other commitments-like my consulting work that has picked up this year. Also this has remained a fairly small audience after a year and a half. I love all you folks, but there just aren’t that many of you. I have some ideas to grow this business in the next 6-9 months that involve treating it more like an investing newsletter with daily updates including portfolio strategies. This will come with a small monthly subscriber fee that hopefully those of you who have been with me for a while will find worthwhile. In the mean time anything you can do to help me spread the word-like reposting articles you find interesting to your respective networks will be appreciated. Cheers

ConocoPhillips, (COP) is a major producer of oil and gas globally, with current production of ~1.8 mm bbl BOEPD. This puts it in a fairly elite class operators that can generate huge amounts of cash from operations annually. With revenues of $75 bn last year, the company generated $34.7 bn in EBITDA putting its EBITDA margin at 46%, about a 25% improvement YoY. This trails smaller competitors with an international footprint, Occidental Petroleum, (OXY), and Hess Corp, (HES) by about 20% with them coming in at 55 and 51% respectively. I see this as more of an observation than a cause for concern. The company is having to increase capex in a number of areas that will yield future returns that will push EBITDA higher, justifying higher multiples. Higher cash flow will come with this investment, so it doesn't particularly concern me in a stable or rising oil price environment.

Like many operators with more than $100 bn+ in market cap category, COP has an attractive, but not industry leading Return of Capital program consisting of a target of 50% of OCF. Ryan Lance, CEO noted in the Q-1, 2023 call they were on track to deliver $11 bn this year as a combination of share buybacks and dividends. The company has a solid balance sheet and can support its various projected capital outlays for the year, on track towards $10-11 bn, with cash flow while meeting all its other obligations.

COP is a company we have had on our target list to own for several years. Is this the opportunity? With a ~30% discount in the shares to recent highs, it might be. Let's take a fresh look. Note-we went long COP this week at $100.50/share.

The thesis for COP

COP is a primarily play on rapidly growing production in the Permian basin, and other low cost assets like Alaska, and in Canada in the Montney shale and recently assuming 100% interest in the Surmont oil sands project. With a substantial part~30%, of the its daily production being gassy, LNG figures prominently in its future. COP has a number of LNG ventures underway including Port Arthur LNG, and the Australian APLNG. Over the past few years COP has streamlined its business portfolio, shedding its refining and midstream segment in 2012 to Phillips 66, (PSX), and in 2015 exiting its GoM deepwater business. The company today is a low cost producer of low risk assets that avoid huge technological or financial hurdles.

Shale

COP has worked hard and shelled out big bucks to enhance its shale portfolio over the last several years. Adding Concho Resources, and Shell's Delaware basin acreage in 2021, COP has emerged as a major player in the Permian basin. This was important as the Permian is the only shale basin still growing.

If you note the 2022 BOE/ft curve in the upper right of the graphic above, you can see it's improved into the mid-30's. COP is a technology company and is using long laterals, high sand concentrations, and well spacing to acheive those results. Additionally, as the slide below reveals, COP is aggressively making trades to improve the "blockiness" of its Delaware acreage. These trades will enhance the cost of supply for these wells, as the incremental drilling costs are more compensated by having to drill fewer wells total.

in monthly output, although we expect this curve will bend in the next few months. As a combination of its superior surface position over some of the thickest parts of the Wolfcamp A, B C, and D intervals and the Upper and Lower Bone Spring, COP is set up to grow its Permian production from the current ~700K BOEPD to 1.1 mm BOEPD toward the end of this decade.

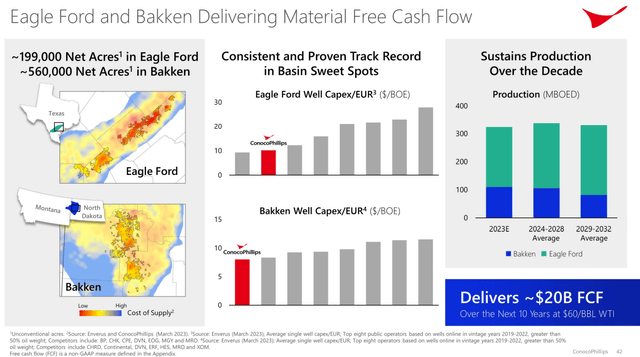

COP's Eagleford acreage looks to be well connected and within the oily northern sweet spot of Live Oak, Karnes, Dewitt, Lavaca, counties with high EUR's at low capex outlays. The Bakken acreage is concentrated in the only two counties that matter-Mckenzie and Dunn, and is very blocky and connected. The Bakken acreage is also in the gathering area to feed into the DAPL for access to marketing terminals.

Surmont and the Montney

Surmont, currently producing 80K bbl from a steamflood reservoir, features very low decline that requires few new wells to maintain production. Technology has dropped costs-less steam with use of solvents, and resulted in emissions reductions that improve the ESG profile of this oil, including CO2 reinjection. COP spent $3 bn for full ownership of this resource, the incremental revenue pays this out in less than three years, leaving decades to produce with only a variable capex load.

In 2020 COP purchased Kelt Exploration's Inga/Fireweed acreage in the Montney, bolting-on to its existing Montney footprint. With COP's technical know how in fracking, the acquisition has been quickly upscaled and costs reduced. Continued rapid development is planned with liquids weighted production rising to ~125K BOEPD 2029-32.

Willow

Now that it has been approved, COP is moving rapidly toward developing the resource that will produce about 200K BOEPD beginning in 2028. The company's long history of operating in Alaska means the learning curve for Willow is shallow to completion and production. The significant infrastructure in place in Alaska have 50 years of production derisks much of Willow and COP's entire Alaskan portfolio.

A catalyst for COP

COP has global reach with its participation in the FERC approved Port Arthur LNG plant, its near 50% ownership of APLNG in Australia, and its participation in Qatar gas' North Field East Expansion. By 2028 the company will be marketing ~13 MTPA of LNG. In each case with its low cost of supply from the Permian, Haynesville, APLNG, and Qatar and exposure to TTF and JKM pricing, revenues and margins should enhanced.

Gas prices are unrealistically low currently and I expect over the next 6 months to year that they will begin to rise out of the current $2-2.50 range. The decline in drilling assurs this. Lower inventories will have an immediate impact on COP's cash flow as this uplift occurs.

Q-1, 2023

First quarter production was a record for the company at 1,792,000 barrels of oil equivalent per day. Lower 48 production set a record, averaging 1,036,000 barrels of oil equivalent a day, including 694,000 from the Permian; 227,000 from the Eagle Ford; 98,000 from the Bakken. And Lower 48's underlying production grew 8% year-on-year with new wells online and strong well performance relative to our expectations across our asset base.

First quarter CFO was $5.7 billion, excluding working capital at an average WTI price of $76 per barrel. This included APLNG distributions of $764 million. Now first quarter capital expenditures were $2.9 billion, including $400 million for Port Arthur Phase 1 and $100 million in Lower 48 acquisitions.

Regarding capital allocation, COP returned $3.2 billion back to shareholders. And this was via $1.7 billion in share buybacks and $1.5 billion in ordinary dividends and VROC payments.

Guidance. COP forecasts second quarter production to be in a range of 1.77 million to 1.81 million barrels of oil equivalent per day, with capex of $10.5-11 bn. APLNG, distributions of 350 million to 400 million are expected in the second quarter. And for the full year, they expect APLNG distributions of $1.8 billion.

COP expect's to return $11 billion to shareholders this year, with $3.2 bn of that already in their pockets for Q-1. $1.7 bn have gone to share buybacks and $1.5 to ordinary and variable dividends. The company has $8 bn in cash on the books and carries $13 bn in debt as of Q-1.

Risks

As a producer of commodities the company is subject to the vagaries of the market that attend this resource. The decline of WTI from the $90's and of gas from the $7's per MCF since November of last year accounts for the decline in COP share over this time. If we were to see further declines it would likely have the same result.

Your takeaway

We remain convinced that petroleum and derivatives will play an important role in global energy security in the coming years. There is no estimate for alternate fuels that diminishes this role in the several decades. Nor is a scenario projected where we use less oil and gas than in the past. The driver of course is the increasing emergence of an energy hungry middle class in areas of the world that hasn't had one until now. That along with the company's compelling low cost, low risk energy strategy, make the case for investment at current prices.

COP has a number of engines that will produce steady and increasing cash flow in the coming years, as we have discussed. Currently the company is trading at just under 4X EV/EBITDA and at $77K per flowing barrel. Very competitive levels with other companies we are recommending, like Chevron, (CVX), and ExxonMobil, (XOM).

Analysts are bullish on COP with price targets that range from $94 on the low side to $165 on the high side. The median is $129, so we can assume the upper range is an outlier we are unlikely to see anytime soon. That median of $129, is certainly acheivable as it was just there eight months ago and provides a decent uplift from current prices over the near term.

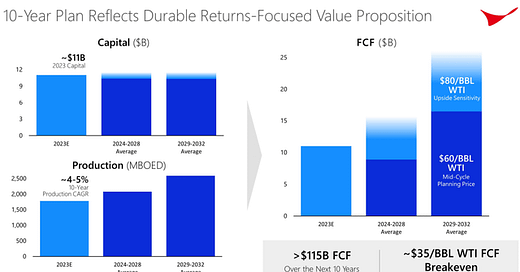

COP projects increasing production to 2.5 mm BOEPD- a 72% increase from current levels, by the late 2020's. Conceptually, and using loose math the cash flow that will come from this increase in production would boost EBITDA toward $55 bn in this time period. To keep the EV/EBITDA multiple the same- 4X, the stock price of COP will have to rerate to $170 per share.

In short I think COP presents a very attractive picture at current prices, and they should be elevated to the DDR. There is room in their cash flow projections for capex to increase substantially as production rises, and to maintain all capital return and debt reduction plans. I will be looking at taking a starter position in the coming days looking for any weakness as an entry point.

Disclosure. The author is long COP.

Disclaimer. Nothing I say in this article should be construed as investment advice. It may look or sound like it, but it is not. I am not a CPA/CFA and have no formal training/certifications/licences in either discipline. In these articles I present analysis and relevant information that an interested investors may find instructive. I may be bullish, bearish, or neutral and will discuss why, but I am definitely not recommending you buy or sell any security I discuss. Investors should always do their own due diligence before plunking down their hard-earned cash. They alone are responsible for their investing decisions