Comstock Resources: The Gas Monster In The Swamp

If you have never toured the swamps of East Texas and Louisiana, you're missing a treat. At some point in your life, make the trip-put on some bug spray first!

Introduction

The Haynesville shall rise again! As a southerner, I just wanted to say that. Actually, as this outtake from last month's DPR shows, it's been cracking right along, ramping up daily output up 60% in the last year and half, spurred on by the rig count growing 2.5X. That's kind of amazing given what's happened with gas price in the last year. Clearly the drillers are taking a long view on the basins prospects. There are good reasons why, as we will discuss.

Conversely, the market has punished this cadre of companies-Comstock, Southwestern Exploration, (SWN)-(We wrote up SWN last year favorably at about $6.00 per share), and Chesapeake, (CHK), taking down their stock prices by as much as half. You could call that a win actually as it's slightly disproportionate to the 3X decline in gas prices for the same period. Such is the case for Comstock Resources, (CRK), under $11 after peaking in November, of 2022 just above $21. That's the kind of delta we like around here, and makes it worth our while to take a closer look. CRK is new to this blog as we spent a lot of time out in the Permian, and up in Canada. All time well spent, but let's have a look at the rationale for this Haynsville driller to see what is keeping hope alive.

The thesis for the Haynsville

Thanks to new LNG capacity coming on line about 15BCF/D new production will be needed in the next 5 years, as noted by RBN in a December 21st, blog posting. Even more by 2032 as this RBN graphic shows.

If you include projects that are under open season committment, but have not yet met FID, you have nearly 29 BCF/D needed by 2032. RBN notes further that there is a mismatch of about 1.5 BCF/D on the Texas side, but a gap on the Louisiana side of just over 2-BCF/D.

RBN sums the situation up pretty well in this quote below-

That mismatch of production vs. feedgas demand, in turn, will have a significant impact on how Gulf Coast LNG facilities source their gas, as well as on pipeline development, gas-flow patterns and pricing dynamics in the region, including premium pricing in Louisiana vs. Texas as LNG export growth keeps the gas market there tight for potentially the next decade.

Premium pricing and a gap between demand and supply makes the long term case for the Haynesville and CRK.

A few facts about CRK

As they note below this footprint doesn't include the Western Haynesville acreage they proved up in the 2-Robertson County, Texas wells they brought in. I am sure "competitive reasons" means there is leasing underway and they are looking to protect their position. They do refer to it obliquely in the second bullet on the slide below.

The three key takeaways from this slide are-

Low cost/high margins. Reading their color table to the right, it looks like rolled up costs per MCF are well below their nearest gas peer.

A solid footprint in some of best of the core Haynesville/Bossier play-DeSoto and Caddo parrishes.

Nearly 1,600 PV-10 drilling locations.

It is also worth pointing out that Comstock's acreage is the blocky sort that enables the long horizontal legs that lower costs. Overall D&C costs are higher because the lateral length has increased 13% in 2022 alone. You'll remember the best way to get more production out of a well is to extend the lateral section.

A catalyst for Comstock

The Robertson country wells are coming in well above the typical 26 mm per day seen over in DeSoto and Caddo parrishes. Daniel Harrison, COO comments on the results from the first two wells in Robertson county, Texas.

We completed our second well in our Western Haynesville area. The KZ Black number 1H well was completed in the Bossier with a 7,912 foot long lateral, and it was turned to sales in November. The well was tested with an IP rate of 42 million a day. After we got the KZ well tested, our total field production exceeded the existing treating capacity in the field and the wells were curtailed to slightly below our treating capacity.

Prior to being curtail, our first well completed in the field, our Circle M well was producing at a flat rate of 30 million a day since we turned it to sales back in April of last year with the exception of being shut in for the month of October, while the KZ Black well was being completed. The existing treater is currently being expanded. We expect to have additional treating capacity available basically by the beginning of the second quarter.

We're currently completing the third well on our Western Haynesville acreage, which is the Campbell B #2H well. This well was drilled in the Bossier formation with a 12,700-foot long lateral. We anticipate turning this well to sales by the end of next month. We also have two rigs currently running on the Western Haynesville acreage that are drilling our fourth and fifth well.

Company filings

In fact they came in so well the surface equipment wasn't able to handle it, as the commentary notes. Often times gas in this part of Texas is sour and they have to "treat out" the H2S before sending it down a sales line. Hydrogen sulphide is corrosive and dangerous-it will kill you quickly at concentrations of 700+ ppm. That's not very much.

Comstock is having success with long laterals., In 2022, 16 of their 66 total wells turned to sales were extra-long lateral wells greater than the 11,000 foot length. Included in these 16 extra-long lateral wells turned to sales were six wells that we completed with laterals longer than 15,000 feet. Notably their longest lateral well to-date with a completed lateral of 15,726 feet was drilled on their East Texas acreage

The bottom line here is it appears that Comstock's western acreage is more productive per foot of interval (higher pressure, more permeability, perhaps lower stimulation costs), than the core Louisiana sector of the play. This should translate into more profits. Useful at a time when gas prices are struggling.

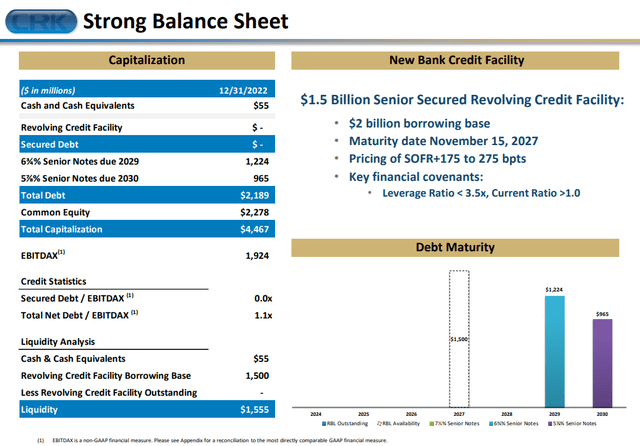

Balance Sheet

Comstock recently entered into a new 5-year credit facility with 17 banks, which lowered its interest costs and increased availability on their revolving facility. The leverage ratio was improved to 1.1x down from 2.4x in 2021. There are no significant maturities until 2027. Management also noted the conversion of Jerry Jones preferred equity to common stock as a sign of the company's strength.

And the $175 million in preferred stock that help fund the Covey Park acquisition was converted into common stock at the end of November. This is a key point. The conversion of the preferred by Jerry Jones is a statement demonstrating his confidence in the future of the company and his belief that ownership of Comstock Equity is the greatest potential for future appreciation.

Company filings

Hedging

In the middle of last year many operators went "bare" (unhedged) to capture market prices, at the time the highest seen in a decade. As we now know, those exorbitant prices didn't last long and sound hedging to insure cash flow is a prudent practice for a gas operator.

Comstock scored a win for the quarter by hedging the majority of its Q-4 production to the NYMEX contract. During the fourth quarter, the quarterly NYMEX settlement price averaged $6.26 per Mcf and the spot price averaged $5.60. During the quarter, they nominated 81% of their gas to be sold at index prices tied to that contract settlement price, and then the remaining 19% of their gas was sold in the daily spot market.

Looking forward in 2023, Comstock takes what I would call a middle of the road approach here, hedging 30% of its 2023 total with collars. This gives a floor for pricing while allowing for spikes. The bulk of their 2023 is still on the spot market, but I expect more hedges to be put in place as the year progresses.

Q-4, 2022 and Full year, and 2023 Guidance

Comstock generated free cash flow from operations of $673 million in 2022, including $129 million in the fourth quarter. Production in the fourth quarter increased 7% from last year to 1,445 MMcfe per day. Oil and gas sales, including realized hedging losses, were $2.3 billion in 2022 and $558 million in the fourth quarter and were 58% and 47% higher than 2021 and 2021's fourth quarter. Hedging is expensive, but it guarantees operating cash flow and is a prodent investment on management's part. I suppose shareholders of Silicon Valley Bank, (SIVB) wish the management of that institution had managed their risk a little more conservatively!

Cash flow from operations in 2022 was $1.7 billion or $6.21 per diluted share, including $434 million in the fourth quarter or $1.57 per diluted share. Adjusted EBITDAX in 2022 increased 72% to $1.9 billion and in the fourth quarter increased 61% to $478 million.

2022 drilling program drove 9% reserve growth with 1.1 Tcfe of drilling related reserve additions achieving an overall finding cost of 95¢ per Mcfe. Improved balance sheet with retirement of $506 million of debt and conversion of preferred stock.

Resumed quarterly dividend of $0.125 per share in December 2022.

Guidance for Q-1, 2023

First quarter production guidance is 1.375 to 1.435 Bcfe per day, and the full year guidance is 1.425 to 1.55 Bcfe per day. During the first quarter, they plan to turn to sales, nine to 12 net wells. CapEx guidance, had been set it at $275 million to $325 million, with full year development CapEx guidance is $1.05 billion to $1.15 billion.

2023 wells will have an average lateral length being approximately 10% longer than 2022, which is helping to offset some of the cost inflation. In addition to the drilling program, they are targeting spending up to $25 million to $35 million on additional bolt-on acquisitions and new leasing.

This year, the DD&A rate is expected to remain in the $0.95 to $1.05 per Mcfe range.

Company filings

Risks

Inflation is the big risk with Comstock. The Haynesville is deeper and hotter-and tighter than reservoirs. This brings advantages and disadvantages. The cheif disadvantage is cost. Costs were substantially higher in 2022. The fourth quarter D&C cost averaged $1,425 a foot. This is just a 1% increase compared to the third quarter. The D&C cost for the full 2022 year averaged $1,329 a foot, and this represents a 28% year-to-year increase. The good news is costs appear to be flattening, and as we have discussed in chat, have the potential to flatten still further. This showed up in Q-4.

Their fourth quarter drilling cost was $582 a foot. This is a 3% decrease compared to the third quarter On the completion side, their cost for the fourth quarter came in at $843 a feet, which represents a 4% increase compared to the third quarter. For the 2022 full year, completion costs came at $806 a foot.

The LNG business on which we are basing this thesis may not develop as we present. With the 20% higher gas stocks this year than last, with the prospect of increased demand, gas prices may not see a bump during injection season.

Your takeaway

I think Comstock is a steal at current prices, down ~50% from November highs. The stock is trading at low multiple (EV/EBITDA-2X TTM). On production of 565 BCF during the course of the year they should at least generate EBITDA of ~$1.5 bn on a purposely bearish average sales price of 3.65 MCF. That will cover planned opex of ~$1 bn for the year, the full year dividend of ~$140 mm, and debt reduction which the company has prioritized, noting in the Q-4, 2022 call that another $100 mm in LT debt would be paid down in Q-1, 2023. Hedging costs for 2023 should be well below 2022 and covered with cash flow.

The company proved to be fairly nimble at marketing spot production to good effect on the cash flow in 2022, and I would expect no less for this year.

The company is also trading at a substantial discount to SEC proved reserves. In 2022 they grew 1P reserves 9% to 6.7 Tcfe and replaced 216% of their 2022 production. Management made a point of this in the Q-4 call.

Our 1P PV-10 value totaled $15.5 billion, highlighting our attractive cost structure we achieved an 83% EBITDAX margin, which is one of the highest in the industry. In addition, we achieved a 28% return on average capital employed and a 62% return on average equity. In 2022, we added 98,000 net acres that is prospective for the Haynesville and Bossier shales for $54.1 million or $550 per acre.

Company filings

Bottom line, the company has a strong acreage position which enables a leading cost structure as compared with peers. The balance sheet is solid with no debt walls in the near term, and is able to fund obligations internally with a bearish gas price which they will likely exceed. The time to buy stuff is when there is blood in the streets, and I would say CRK at these levels meets that criteria.

Just over the horizon hangs the promise of export pricing when LNG capacity picks up in 2024-5. If you think that will become a reality, CRK may rate a place in your portfolio for growth!

Disclosure. The author has no position in CRK but may take one in the next 72 hours.

Disclaimer. Nothing I say in this article should be construed as investment advice. It may look or sound like it, but it is not. I am not a CPA/CFA and have no formal training/certifications/licences in either discipline. In these articles I present analysis and relevant information that an interested investors may find instructive. I may be bullish, bearish, or neutral and will discuss why, but I am definitely not recommending you buy or sell any security I discuss. Investors should always do their own due diligence before plunking down their hard-earned cash. They alone are responsible for their investing decisions.