A company that got my attention by way of a tip from one of my regular readers, is CGX Energy (OTCPK:CGXEF). The company is a Toronto, Canada-based E&P company with significant Petroleum Production Licenses - PPLs - on and offshore, Guyana. So I dug in. What I saw was interesting…but speculative. Very speculative.

There is no news since mid-December on the company’s site but the Rumorverse abounds. We will avoid the rumorverse in this article. Details and some analysis from the December update will be discussed.

Bottom-line: this is a very speculative investment case that regards a company that is essentially bankrupt, with no revenue, and a key investor who’s recently taken more shares for operating capital. It is the very definition of high risk. The otherside of that is high reward, the thesis for which we will also discuss. Grab a cup of coffee, and let’s dig in.

CGX assets in Guyana

There is no hotter exploration play in the world right now with the success Exxon Mobil (NYSE:XOM) has had proving up the petroleum system with its track record of 18 commercial discoveries and 8-billion bbl of oil booked into reserves over the last 5 years. Apache/APA (NASDAQ:APA) and TotalEnergies (NYSE:TTE) have done the same on a smaller scale offshore, Suriname.

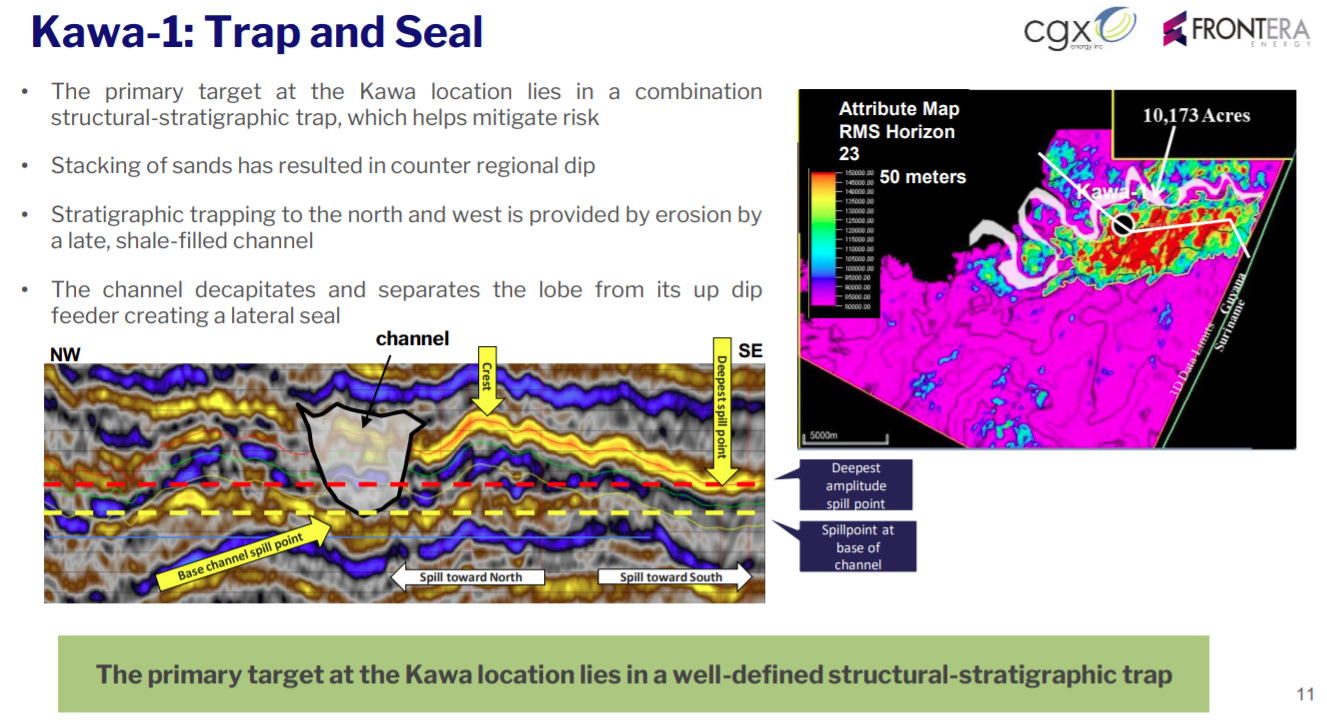

Long story short, the company with its partner Frontera Energy (OTCPK:FECCF) has been drilling the Kawa-1, in the Corentine PPL. A contract has been let to Maersk Drilling for the Maersk Discoverer to drill a 6,500 M exploration well-Kawa-1 in this block in 370 M of water.

Worth noting as well is the company's hiring of top-flight talent to run operations. Kevin Lacy, ex-Chevron (NYSE:CVX) VP of Drilling and Completions, was named Drilling Director for the wells to be drilled at Corentyne and Demara. Now, he is just one guy, but I think you will agree that it lends gravitas to have someone with his pedigree running the show for CGX. Later on, I'll make the point that a tiny company like CGX has absolutely no business doing deepwater exploration. Having someone with Lacy's credentials helps to make it feasible over the short run. I'll put forth my idea of next steps assuming a discovery is made, a little further down the page.

The map above from Frontera Energy's site does a pretty good job of laying out the prospective potential of this well. The graphic below from a CGX presentation shows the target, believed to be a sandstone reservoir with properties similar to those reported by Apache in their wells listed below, offshore Suriname.

Kawa#1

Now, let's understand, the Kawa-1 is a wildcat well that spud in Aug, 21 offshore Guyana looking to extend the play established by XOM and others. That said, the success of these exploration wells and sanctioned Liza-1 (producing), Liza-2, (startup 2022), and the Payara (underway with first oil in 2024), along with the associated infrastructure, to an extent derisks the Kawa-1. The same holds true for the work Apache and TTE have done in the last couple of years, offshore Suriname. When you look at the juxtaposition of the Kawa-1 to Haimara and Pluma on the Guyana side, and the Maka on the Suriname side, it's not too hard to imagine that when they run the log, folks on the rig will get pretty excited. We should be in or nearing the logging phase now.

We won't know for a couple of months likely as the results will be "tight-holed" until the companies are ready to make an announcement about the success or failure of the test-DST.

December 17th update on the Kawa #1.

To date, approximately 90% of the planned footage has been drilled and the initial results suggest an active hydrocarbon system is present at the Kawa-1 location. Horizon 19, the first of three geological zones targeted by the Joint Venture, has been penetrated. Logging-While-Drilling and cuttings indicate the presence of hydrocarbons in several Campanian and upper Santonian formations. The Joint Venture will run the planned 9 5/8" liner at current depth, then drill ahead to the main Santonian target zone (Horizon 23) and the deeper secondary Santonian target zone (Horizon 25). The initial geological results will be further evaluated by wireline logging at the end of the well as part of the logging program for the deeper zones. The Joint Venture is pleased to report that drilling operations have recorded only a single lost time injury since August and Covid-19 protocols have resulted in no disruptions to operations and no positive cases detected after arrival on the drilling unit. Drilling has taken longer than originally forecast and costs are projected to increase. The current cost estimate of the Kawa-1 well is now forecast to be approximately $115-$125 million. The Joint Venture will provide an update on costs and will issue full exploration results of the Kawa-1 well once total depth has been reached and results have been analyzed. CGX may be required to seek additional financing in keeping with the ongoing drilling program and is currently assessing several strategic opportunities.

It is no great surprise that costs and time have run higher. Both XOM and TTE/APA have reported drilling difficulties when drilling Santonian targets. Here’s an excerpt from an article APA Corp, (APA), that I published on another platform earlier this year that highlights the pressure regime in the Santonian causing problems.

Keskesi tested 63 meters of net pay containing black oil, volatile oil and gas, in the Upper Cretaceous and Santonian horizons, and was drilling toward targets in the Neocomian when high pressure forced a T&A on the well. Before reaching the Neocomian, hydrocarbon shows were also seen in the Lower Cretaceous.

Author’s files

The concerning thing about CGX is that it is essentially bankrupt and being carried by the JV partner, Frontera Energy, which is in turn funded by a private equity firm, Catalyst Capital.

The comment about “Strategic Options” usually means that they are peddling a farm-in to another, better funded operator, or considering a further capital raise. My thoughts are Frontera and Catalyst Capital are in so deep (NPI) that they will come up with the cash to finish and log the well.

The stock has been in major rally-mode since mid-December’s announcement of drilling progress, rising from $0.69 to a 6-month high yester of $1.80. It is interesting to note the late in the stock yesterday, December, 30th. At 3:43 PM, just before the close it pushed higher to $1.80, and closed at $1.79.

Demara prospect

A future exploration well is planned in the Demarara prospect, but it is still in the seismic data processing stage. According to the Q-1 financial document, this was to be completed last May. The deadline for spudding this well is February 11, 2022. It's not a huge leap to think the Discoverer will move to that location when it finishes with Shell. Or it could any one of a number of idle floaters in the vicinity.

Future work is also planned on the Berbice prospect with a seismic program planned for August of this year, and exploration well to spud by June 15, 2022.

Deepwater port in Guyana

Last year, the company secured a 50-year lease on-site at the mouth of the Berbice river. According to its Q-1 filing, work has begun on this resource.

Starting in October 2020, Grand Canal Industrial Estates Inc. (“Grand Canal”), a wholly-owned subsidiary of the Company, entered into various contracts to recommence work on its Berbice deep water port project. Work has continued during the three month period ended March 31, 2021 and Grand Canal had expended $327,000 for this period. Additionally, the Company awarded contracts for $2,003,000 in April 2021.

There is no surer path to riches than running a major port of entry in a growth area like Guyana. Regardless of how the oil exploration turns out, this factor alone is enough to consider buying into the company at current prices.

The thesis for CGX

Let's face it a tiny company with little or no revenue, like CGX, has absolutely no business doing deepwater exploration. Without Frontera fronting the cost for the Kawa-1 well, it wouldn't be happening. Frontera has advanced CGX $19 mm for its share of the cost of drilling Kawa-1, and has the option to convert this debt into shares of CGX at a rate of $0.71 per share. For that matter, Frontera, with an enterprise value of ~$900 mm, has no real business doing deepwater exploration either. Frontera is in even deeper now with the CGX cap raise being totally subscribed by them.

Nope, they are hoping for a "big daddy" to buy into their dreams, sort of like what happened with Apache and TotalEnergies. And, depending on the results of the Kawa-1, it could surely happen. Any number of companies like Hess (NYSE:HES), or Equinor (NYSE:EQNR) could farm in easily if the Kawa-1 shows pay in any measure close to what its potential suggests.

Guyana

I am not going to make a big case about Guyana. If you follow oil and gas news, you are well aware of the splash the country has made in recent years, with the XOM discoveries. The country is past the tipping point and is going to become a major oil-producing state. The last time I checked XOM was producing 400K BOEPD from Stabroeck and expects to pump as much as ~2-mm BOEPD by 2024. Even though XOM has been operating for a few years in Guyana, the country is still in the early stages of a "Gold Rush" type state of development.

The point here is that the necessary onshore infrastructure is being built out by XOM and its partners, Hess, and China National Offshore Oil Company, (CNOOC). The critical mass is in place or being built to allow these other developments to proceed.

Your takeaway

I think CGX presents a compelling investment case at current prices, depending on your risk tolerance. They have no real income at this point so usual financial metrics are unavailable. With 287 mm common shares outstanding, the company has a capitalization of roughly $574 mm. This of course, is absurd and is predicated largely on swags about the outcome of the Kawa #1. If they DH this well CGX stock will revert to the sub $1.00 level.

A reason to believe…

The XOM Haimara well logged 207' of vertical pay, and Pluma logged 127' of high perm sandstone reservoir. XOM hiked its reserve estimate for Stabroeck by a billion barrels when the Haimara and Tilapia-1 discoveries were announced.

If even a tiny fraction of those metrics is announced when the results of the DST are released, my expectation is that CGX will move sharply higher from current levels. Just for fun, since we are speculating, let's assume the log shows 100 mm boe recoverable from this reservoir, or 1/10th the amount XOM booked. That works out to $6.5 bn at current prices and would completely change the story for CGX. For reference, when Apache announced the results of the Mako #1 in 2019 and then the farm in from Total, their stock doubled "overnight" to $32ish per share.

It is risky, of course, and not for the faint of heart. Don't use the rent money to buy shares if this opportunity appeals to you. History is littered with the "corpses" of companies with gamechanger wells that didn't live up to their billing. That said, there are then the Liza-type wells that help overcome a lot of dry-hole disappointment. We won't have long to find out what we have here.

Cheers and Happy New Year, Dave

Disclosure. The author is long CGX and may take a position in Frontera.

Disclaimer. Nothing I say in this article should be construed as investment advice. It may look or sound like it, but it is not. I am not a CPA/CFA and have no formal training/certifications/licences in either discipline. In these articles I present analysis and relevant information that an interested investors may find instructive. I may be bullish, bearish, or neutral and will discuss why, but I am definitely not recommending you buy or sell any security I discuss. Investors should always do their own due diligence before plunking down their hard-earned cash. They alone are responsible for their investing decisions.

I think of CGX Energy as a subsidiary of Frontera Energy. In terms of exposure to the well results, Frontera Energy is the far better bargain (~88%). It is still cheap based on conventional onshore production. EV/CFFO = 2.8; EV/EBITDA = 3.1; ND/CFFO = 0.3; trades at 45% discount to the aftertax NAV@10/share. Production should have grown about 4K boe/d since Q3 2021, and should incrementally increase well beyond 40K boe/d in early 2022.

While the JV has been slowly, carefully, steadily drilling to depth, Frontera has been making acquisitions in Colombia. It has the financial depth to follow through on this well and the next.

I linked back to this article in my short write-up

CGX Energy (CVE: OYL / FRA: GXCN / OTCMKTS: CGXEF): A Speculative Guyana Oil Small Cap Stock

https://emergingmarketskeptic.substack.com/p/cgx-energy-speculative-guyana-oil-small-cap-play/comments

For more oil stocks: https://emergingmarketskeptic.substack.com/t/oil-stocks